The World Bank discontinued the Doing Business Report in September 2021 and is in the process of establishing an alternative indicator to Doing Business, currently known as the Business Enabling Environment (BEE) project. The BEE project is expected to introduce new approach for assessing the business and investment climates from the business opening, operation to closing through the provisions of business regulatory environment of different economies.

Meanwhile, the Thai government, related government officials and SEC Thailand would continuously work on the reformation to ease the business operation and investment in Thailand, promote agility economic activities of the private sector and boost the competitiveness of Thailand.

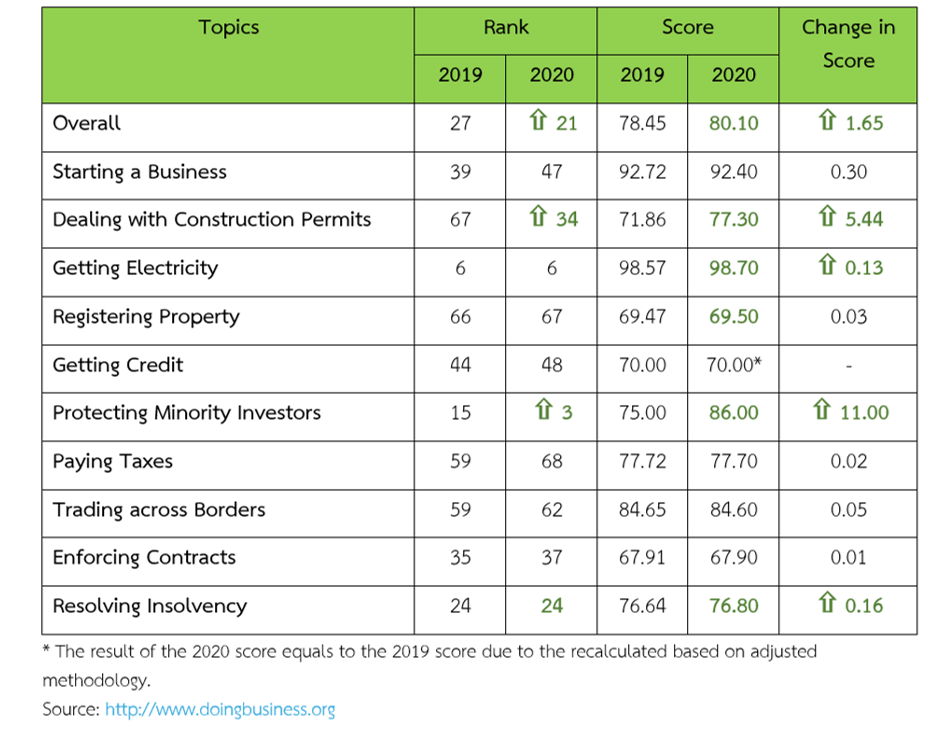

Doing Business 2020 Thailand - Overall Ranking

The

Ease of Doing Business (EoDB) report by the World Bank Group ranks economies

based on their performance on 10 indicators throughout the business lifecycle.

The World Bank collects data from a survey completed by expert respondents

namely government officials, private sectors, and World Bank’s regional staffs

on the implementation of relevant laws and regulations in practice to assess

business environment in each economy. In its Doing Business 2020 report, the

World Bank Group ranked Thailand 21st among the 190 participating economies

worldwide on the overall assessment.

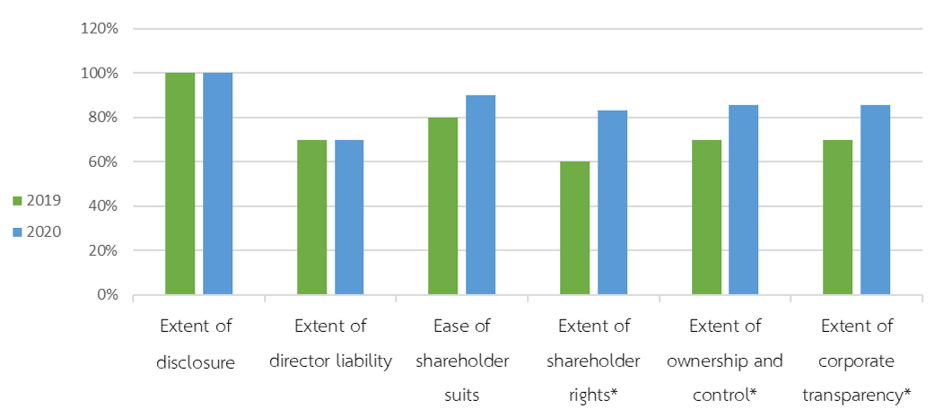

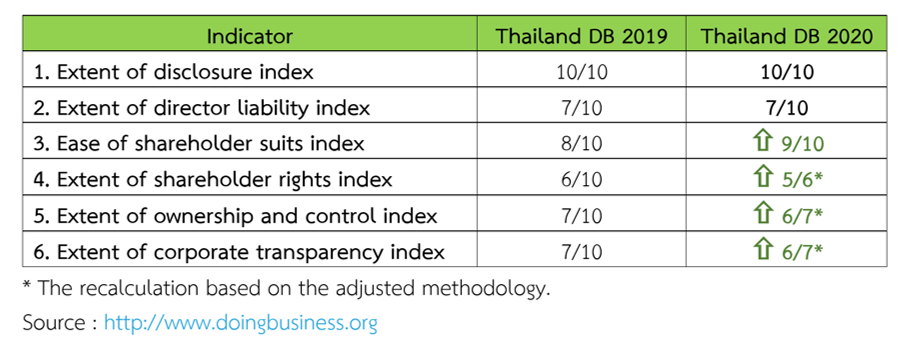

Protecting Minority Investors

The SEC office has involved and supported in the Protection of Minority Investors Topic along with the Department of Business Development, the Ministry of Commerce. This topic measures the strength of minority shareholder protection against directors' misuse of corporate assets for their personal gain as well as shareholder rights, governance safeguards and corporate transparency requirements for listed companies. Positive results on this topic promote investors' confidence which would benefit businesses, the capital market and Thai economy. The index and description are as follows:

Legal Protection and Key Developments

Thailand's ranking in Protecting Minority Investors has risen from the 15th to 3rd this year with

the ease of doing business overall score of 80.10%. Compared with other East Asia & Pacific economies, Thailand and Singapore are at the 2nd place while Malaysia is in the lead.

The higher ranking based on the Protecting Minority Investors Index was due to the initiative on communication strategy. By using a conference call with the World Bank assessors in Washington D.C., the Thai SEC, together with the Court of Justice and the Department of Business Development, the Ministry of Commerce, were able to clarify and create better understanding of the application and the spirit of the relating Acts and regulations made thereunder.

Reformation and Legal Framework