Detail Content

Equity Instruments

Shares

Subscription, sale and allocation

Criteria for limiting the allocation of shares for Initial Public Offering (“IPO shares") which are allocated to sponsors and related parties (“RP") are prescribed to prevent concentrated allocation to sponsors and RP which will enable these groups to control the supply of shares in the stock exchange.

Such criteria may be summarized as follows:

1. Criteria for allocation of IPO shares

The definition of “sponsors" – persons who have done favours which clearly benefit the company, such as customer, supplier, etc.

The process of allocation of shares to sponsors

CEO or MD makes a list of sponsors

The Chief Executive Officer or the Managing Director (CEO or MD) must make a list of sponsors pursuant to the decision of the board of directors, with the characteristics of each sponsor. The company must arrange to have a monitoring process for the allocation to comply with the decision of the board of directors. For instance, an internal auditor may be assigned to monitor the allocation, etc.

2. Proportion of IPO shares being allocated

Sponsors: not more than 15 percent of the total number of IPO shares may be allocated to sponsors

RP and staff of the company and subsidiary: not more than 25 percent of the total number of IPO shares, when combined with the proportion of IPO shares allocated to sponsors

3. Disclosure of information

Disclosure of information on the allocation of IPO shares must be in filing, such as persons who will be allocated, the nature of relations and benefits, and the number of allocated shares

4. Criteria for the reporting of IPO shares allocation and the performance of duties of the underwriter

The underwriter must examine and co-sign the report of shares allocation to sponsors (form 81-1-IPO 200) to certify that “the company has a monitoring process for the allocation of IPO shares to sponsors which complies with related criteria."

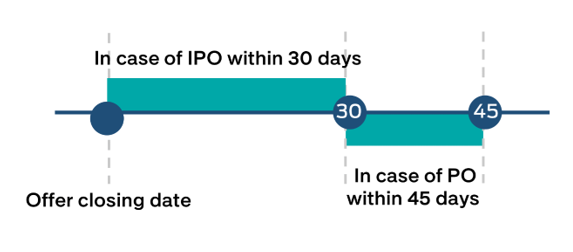

The result of sale of IPO shares must be reported within 30 days after the closing date in the digital system of the SET

5. Other criteria

Criteria for authorizing IPO

The past five years record must not contain doubt that information in filing and application is inaccurate or incomplete, or that important information which might affect the qualifications of the company is concealed.

Offering price for PP is lower than IPO

after the date of application, the company is prohibited from offering to sell PP at a price lower than the IPO price.

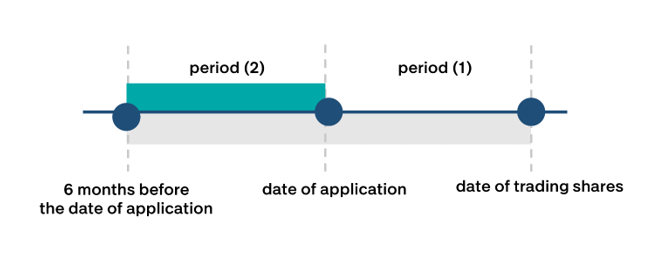

during the six months period before submitting the application, if the company offers to sell PP shares at a lower price than IPO shares, such shares must be in silent period, except where the shares are derived from transactions during the 12-month period. For instance, debt restructuring with debt conversion into capital

Duties after sale of securities

The duties of the securities issuing company begin when filing comes into effect.