Detail Content

Click here for Thai page

Click here for Thai page

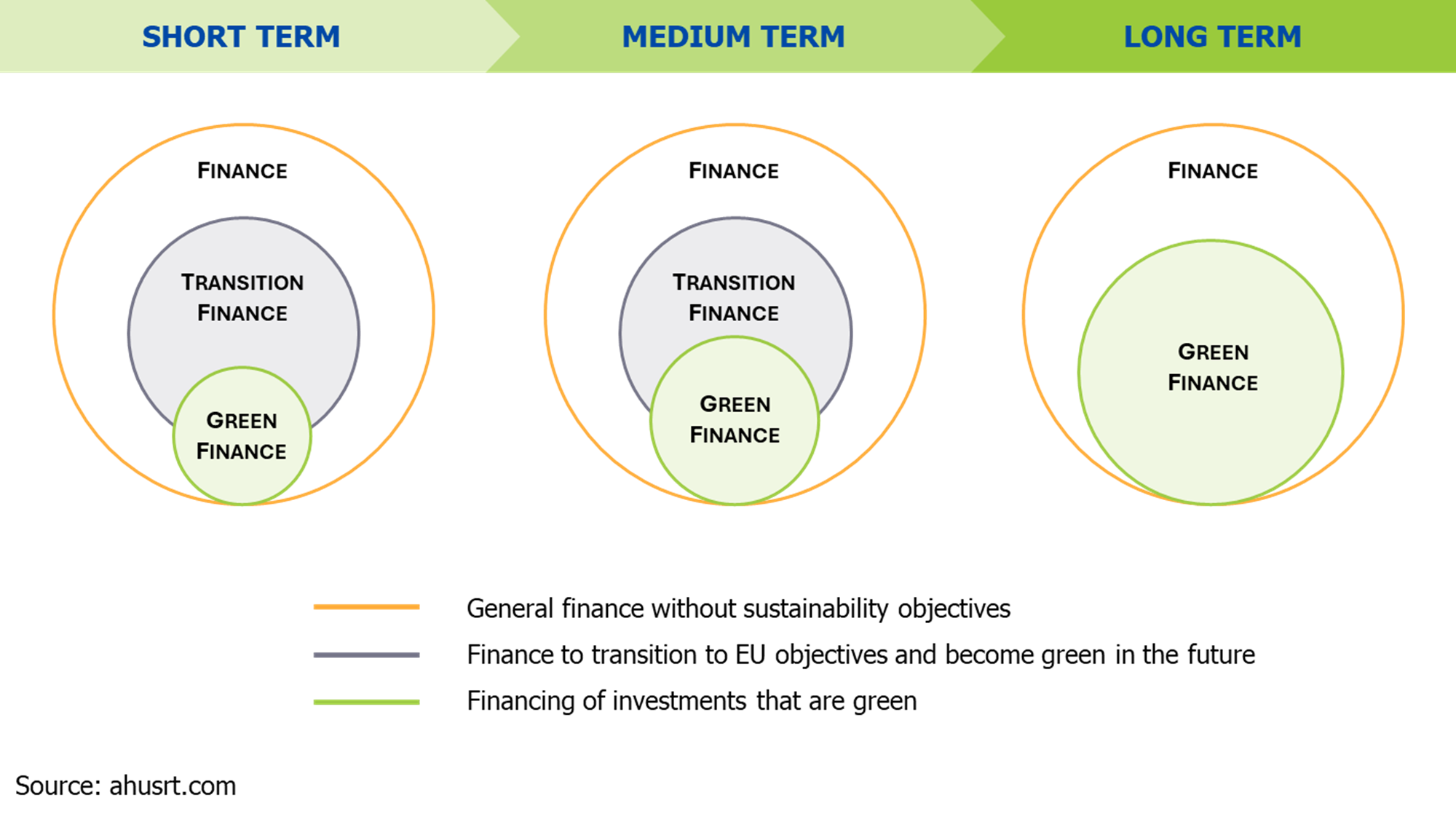

Supporting only green activities may not be sufficient to enable a transition toward a low-carbon economy

Many sectors still have high greenhouse gas emissions or face difficulties in reducing emissions

(hard-to-abate sectors). These sectors are also often essential for driving the economy, such as energy, raw material production for industries like cement and steel.

Focusing solely on green activities (sectors that already emit low or no carbon) may shift attention away from critical sectors. This could prevent the country from transitioning to a low-carbon society in a meaningful and sustainable way and may hinder global efforts to address climate change.

What is Transition Finance (TF)?

Transition Finance is a framework for directing financial flows to support financing or investment in hard-to-abate sectors, where such sectors demonstrate commitments and efforts to reduce their emissions.

The objective of TF is to reduce emissions from hard-to-abate sectors in a meaningful way, aiming to achieve

a low-carbon economy while maintaining the competitiveness of essential industries in the global market. This ensures that vital sectors can transition toward more sustainable and environmentally friendly business models.

Transition Finance Compared with Other Frameworks

1. Transition Pathway

A benchmark for assessing an organization’s GHG reduction performance: The pathway may refer to international reference pathways such as IEA NZE, IPCC, SBTi, and NGFS, which can be calibrated to the organization’s context.

Aligned with scientific principles (science-based pathway): To ensure that the pathway is consistent with global GHG reduction goals, such as limiting global average temperature rise to no more than 1.5°C or 2°C by 2100, compared with pre-industrial levels.

2. Organization’s GHG Reduction Target (transition target)

Targets must be ambitious: The organization should set targets that demonstrate efforts to align with the Paris Agreement, particularly emphasizing GHG reduction in the short to medium term, as much as possible (front-loaded emission reduction).

Targets should be set for the short, medium, and long term

Long-term target: Focuses on reducing greenhouse gas emissions from all sources (not only on-site emissions) to the lowest feasible level, and compensating for the remaining emissions that cannot be reduced, in order to achieve net-zero emissions. This should align with global scientific principles, and organizations should aim to achieve net-zero commitment by 2050.

Short- and medium-term targets: Serve as benchmarks for comparing actual GHG reduction performance along the transition pathway in the short to medium term (before 2030). These targets should include clear and detailed specifications.

Note: When setting pathways and transition targets, it should cover the scop of GHG emission that are significant to the organization’s business (scope 1–3 emissions), including direct emissions, indirect emissions and supply-chain emissions, as applicable.

2. Organization’s GHG Reduction Plan (transition plan)

Specify detailed action plans to achieve the targets: For example: targets, strategies, implementation plans, performance indicators* (KPIs), and monitoring systems.

A living document: A document that can be updated and adjusted to remain aligned with the organization’s evolving context – such as changes in technology, scientific knowledge, or external factors.

* Examples: revenue growth from low-GHG products, or capital expenditure in low-GHG projects

3. Other Tools for Reference

Taxonomy: A classification system for economic activities that are aligned with key environmental objectives, serving as a common language for communication among stakeholders. Examples include taxonomies that define activities within the TF scope, such as Thailand Taxonomy, ASEAN Taxonomy, and Singapore-Asia Taxonomy.

Technology roadmap: Documents outlining the technologies required for each sector to align with the Paris Agreement over time. Examples include Japan’s Technology Roadmap for “Transition Finance”.

Principles of TF Policy

Inclusivity: To ensure that all sectors of Thai industries (especially hard-to-abate sectors) can access financing to transition toward a low-carbon society. Therefore, TF must have an inclusive scope and create opportunities for businesses to mobilize capital to reduce GHG emissions.

Credibility: To address risks of greenwashing, where entities may claim environmental benefits without delivering real environmental impact. TF must therefore include clear principles and practical guidelines so that businesses can set targets, report progress, and demonstrate accountability for their GHG reduction actions. Credibility is further strengthened through third-party verification conducted by external reviewers.

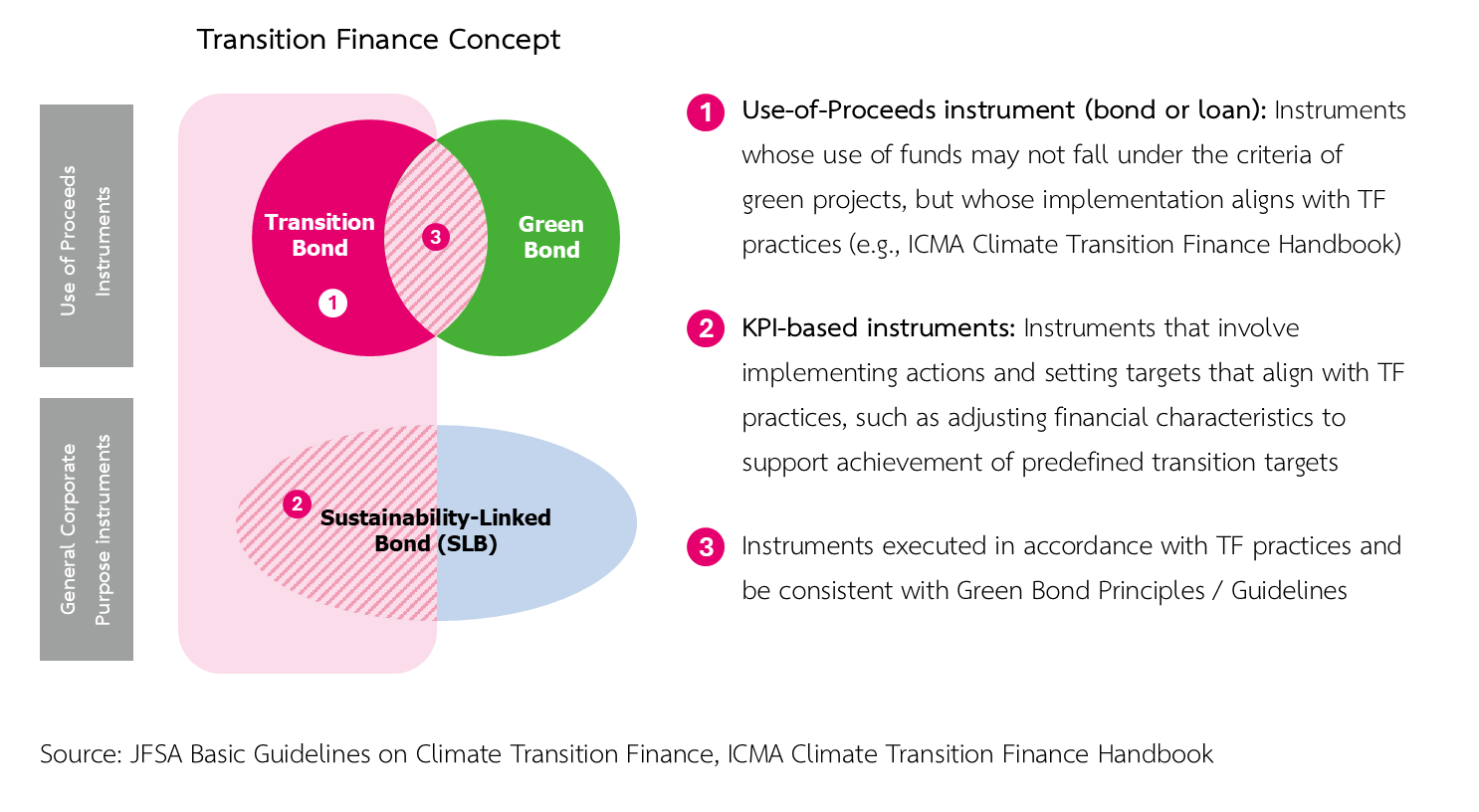

TF Principles Cover Both Use-of-Proceeds and General Corporate Purpose Instruments