Detail Content

Equity Instruments

Shares

Public Offering (PO)

Importance is given to good corporate governance as follows:

Protection of shareholders' right and fair treatment of shareholders

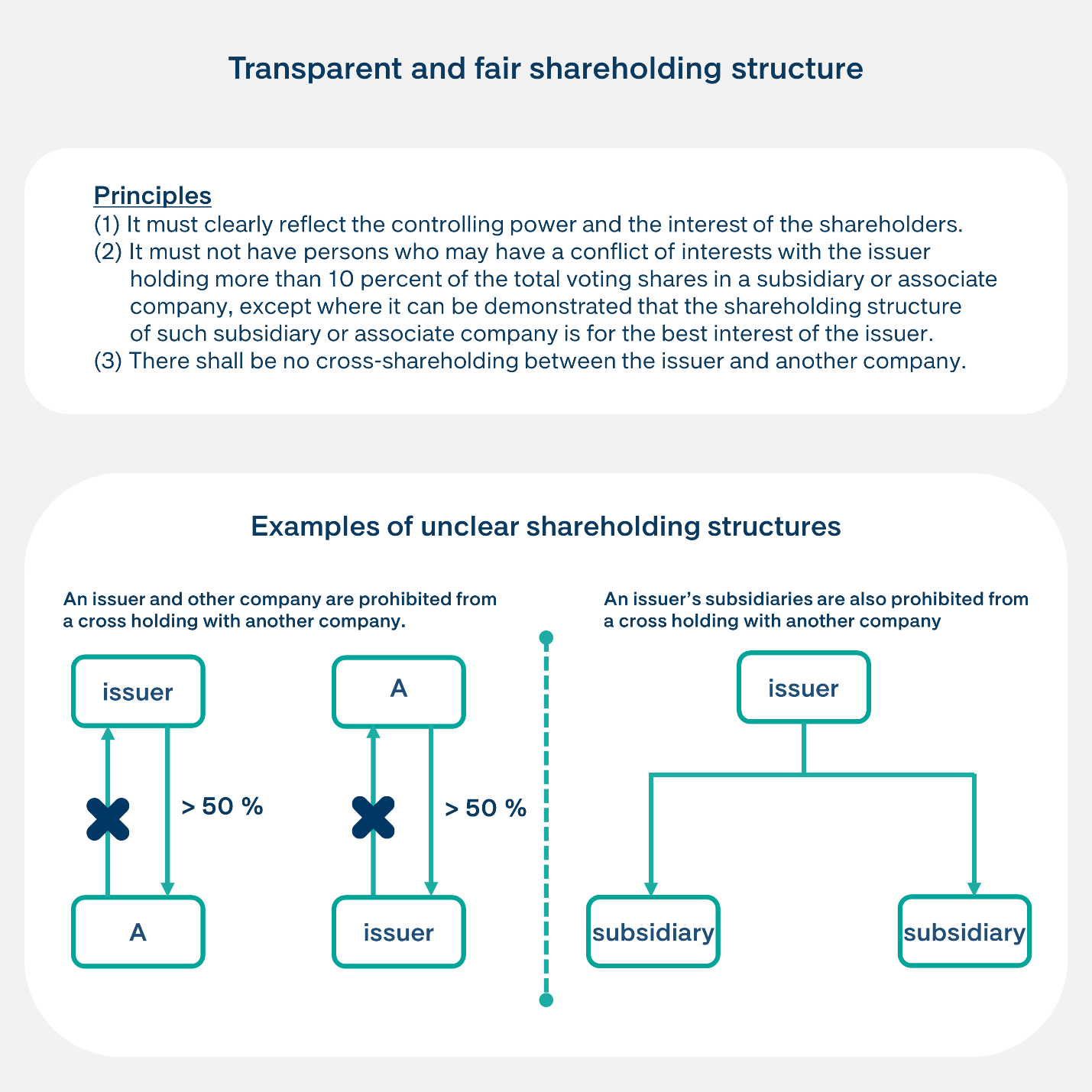

Transparent and fair shareholding structure;

Directors, executives and major shareholders do not have conflict of interests or there are adequate measures to manage conflicts of interest;

There is no reason to doubt that the management mechanism will be unable to protect the rights of the shareholders or to treat the shareholders fairly. The role, duties and responsibility of directors/ executives

The board of directors has a good understanding of its roles, duties, and responsibilities to the shareholders who are the public and can demonstrate that it can perform such duties;

The structure of board of directors have sufficient checks and balances;

Directors/ executives/ controlling persons must not have untrustworthy characteristics.

Disclosure of information is complete and sufficient for making a decision to invest, and not misleading in substance

Other qualifications

Summary of important criteria in relation to the issuing and offering of shares

Request for Approval

Directors, executives and majority shareholders do not have conflict of interests or there are adequate measures to manage conflict of interests

Principles: Controlling persons or those who have influence on a listed company (directors, executives and majority shareholders) have personal interests (both directly and indirectly) that may be in conflict with the company's interests which results in such persons' failure to make a decision or to perform their duties for the best interests of the company. Therefore,

A person who has a conflict of interest must not do business which is in competition with the company.

There must be no related party transaction (RPT) or potential RPT or if there is, there must be adequate measure to manage conflict of interests.

The company must not be dependent on the business of a person who may have a conflict of interests.

The following restructuring process to eliminate conflict of interests must be true transaction:

4.1 Executives / majority shareholders of the company sell shares of the company in which such persons have conflict of interests to an outside person.

4.2 Executives of the company resign as executives of the company in which such persons have conflict of interests.

Ways to resolve conflict of interests

|

| Conflict of interests | Solutions

|

- Related party transactions

| - The pricing of the RPT must be

determined with reference to the market

price;

- A clear contract and policy is made;

- Fair conditions for the transaction are

set;

- There are other groups of shareholders

that can counterbalance;

- Monitoring of transactions that occur;

- Frequent revision of the appropriateness

of the methods used.

|

| - Clear separation of target group of

customers or markets;

- There are other groups of shareholders

that can counterbalance;

|

The roles, duties and responsibilities of directors/ executives

Principles

The board of directors has good understanding of its roles, duties and responsibilities (through the training by IOD).

- The structure has check and balance system:

Independent directors and the audit committee are independent pursuant to the rules.

Independent directors are ≥ one-third of the total number of directors but not less than three persons.

The audit committee consists of at least three persons and at least one person must have adequate knowledge to review the reliability of financial statements.

The scope of power and duties is clearly specified.

Directors / executives must not have untrustworthy characteristics pursuant to the specified criteria and have their names on the database of directors and executives of issuing companies.

Qualifications of a director

Not having untrustworthy characteristics. For example:

Being an insolvent person or an incompetent person

Being banned under the law on Supervision of Financial Institutions, either Thai or foreign law, provided that such prohibited characteristics are related to corruption, fraud / managing work in violation of law or in contrary to the order of the regulator / acting in contravention of the laws or acting unfairly or in an exploiting manner.

Having been sentenced to imprisonment by the court's final judgment on offences pursuant to the prescribed section and it has not yet surpassed an interval of three years after either the person completed the term of imprisonment or the suspension of sentence period ended.

Having been sentenced to imprisonment by the court's final judgment on public offences relating to deceitful, fraudulent and corrupted management and it has not yet surpassed an interval of three years after either the person completed the term of imprisonment or the suspension of sentence period ended.

Having been subject to the court's order of asset seizure under the Counter Corruption Act and the Anti-Money Laundering Act and it has not yet surpassed the three-year interval time after the date on which the court issued such order.

Having been accused by the SEC on offences under 3, which is a ground for

the SEC Office to file criminal complaint against such person with the inquiry official,

and being under investigation by the inquiry official, or under consideration

and prosecution of the public attorney or court.

Qualifications of an independent director

Holding no more than one percent of the total voting shares.

Not being an executive director involved in the management of the business, employee, staff, advisor earning regular monthly salary, controlling person during the period of two preceding years.

Relaxation of this requirement is in the case where the person is retired as a government official or as a consultant of a government agency which is a majority shareholder or has controlling interest for less than 2 years.

Not being a person who is relate by blood or legal relations with a director or an executive.

Not having a business relationship with including not being the significant shareholder or the controlling person of a juristic person having a business relationship with the company in an amount staring from 20 million baht or more or from three percent of NTA, whichever is amount is lower, unless such foregoing relationships have ended for at least two years prior to the date of filing.

Not being an auditor of the company, its parent company, subsidiary, associate company, a major shareholder, a controlling person, unless such foregoing relationships have ended for at least two years prior to the date of filing.

Not being a provider of professional services, a significant shareholder, controlling person, or partner of such provider with a service fee of more than two million baht per year during the period of two preceding year.

* In case of a person who has qualifications inconsistent with 4 and 6, he or she shall be granted an exemption from such prohibition, provided that the issuer has obtained an opinion of the board of directors indicating that after a consideration in accordance with the principle in Section 89/7, the appointment of such person does not affect the performance of duties and the giving of independent opinions, and that the following information has also been disclosed in the notice calling the shareholders' meeting.

Not being a director who is appointed as the representative of directors of the issuer, major shareholder or shareholder who is a connected person of a majority shareholder.

Not undertaking any business of the same nature and in competition with the company and the subsidiary, or holding more than one percent of the voting shares, or being a managing director, employee, staff, advisor with a regular monthly salary, person with controlling interest in such business.

Not having any other characteristics that cause the inability to express independent opinions.

An independent director can be an independent director of an affiliated company, but a member of the Audit Committee is prohibited from being a director of a parent company, subsidiary or subsidiary at the same level (sister company) which are listed companies.

After being appointed as an independent director, that independent director may be assigned by the board of directors to make a decision on the business operation, the parent company, subsidiary, associate company, sister company, major shareholder or controlling person in the form of collective decision. However, a member of the Audit Committee is prohibited from taking part in the decision-making on the business operation.

Qualifications of a member of the Audit Committee (AC)

Being appointed by the board of directors or the shareholders' meeting.

Being an independent director.

Having duties in the same nature as specified in the Notification of the Stock Exchange of Thailand.

At least one person shall have knowledge and experience to review the reliability of financial statements.

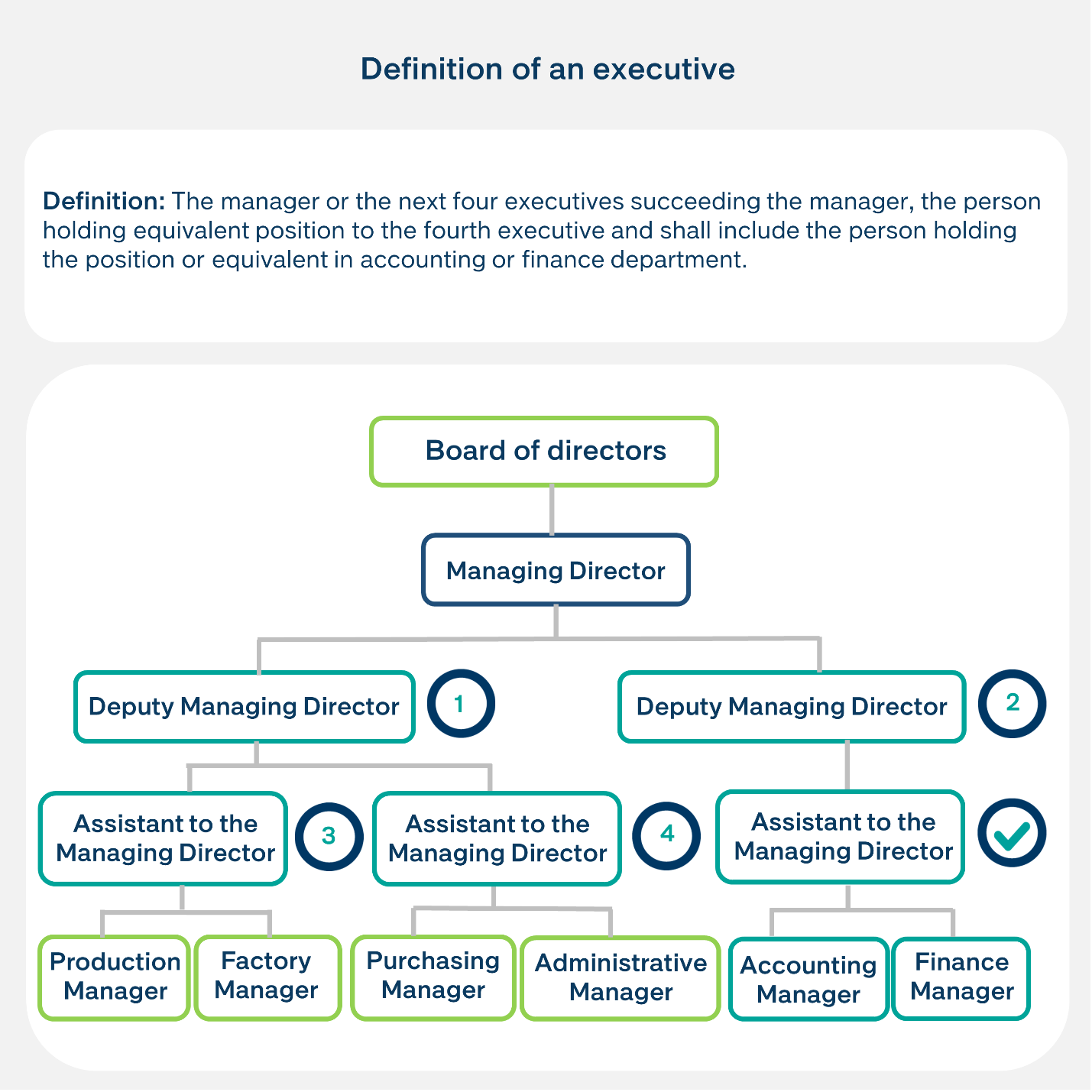

Definition of an executive

Disclosure of information

Annual and quarterly financial statements as reviewed and audited by an sec-approved auditor in compliance with accounting standards of a public company limited (in case of financial statements ending on or after 31 December 2013, three most recent annual financial statements and the last quarterly financial statements must be submitted), in conjunction with other criteria pursuant to Section 56 of the Securities and Exchange Act (including the case where a company limited is transformed into a public company limited).

Audit reports do not have the following nature: no opinion / there is an opinion that the statements are incorrect / there are substantive conditions that the reports do not meet the standards / limited in scope by the company or the executives.

There is no reason to doubt that the information being disclosed is incomplete or insufficient.

There is no reason to doubt that the company does not have sufficient system to disclose information in a continued and credible manner.

Good internal control

Specify the scope of powers and duties and approval of transactions in a transparent form in writing.

Separate the powers to approve, record accounts, manage assets and audit.

Persons charged with the duty to review and check must be independent from each other and do not have common interests.

No one is authorized to approve transactions which are not standard transactions with an amount which is too high in comparison to the company's size.

Evaluate the sufficiency of the internal control system at least once a year.

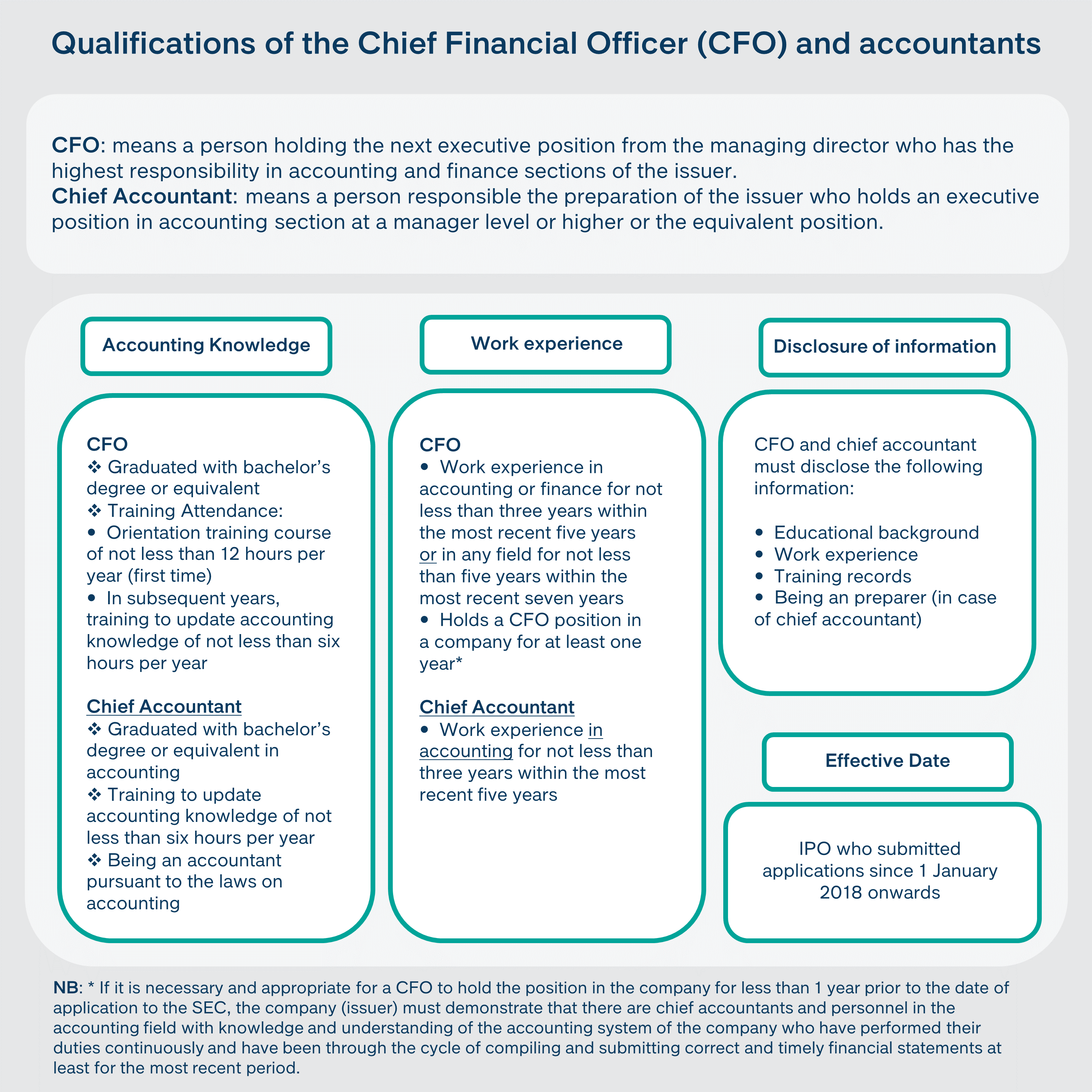

Qualifications of the Chief Financial Officer (CFO) and accountants