Equity Instruments

Shares

Private Placement (PP) of shares and warrant – in case of a listed company

Criteria for approval: can be divided into four cases, depending on the nature of share price indication based on the resolution of the shareholders' meeting.

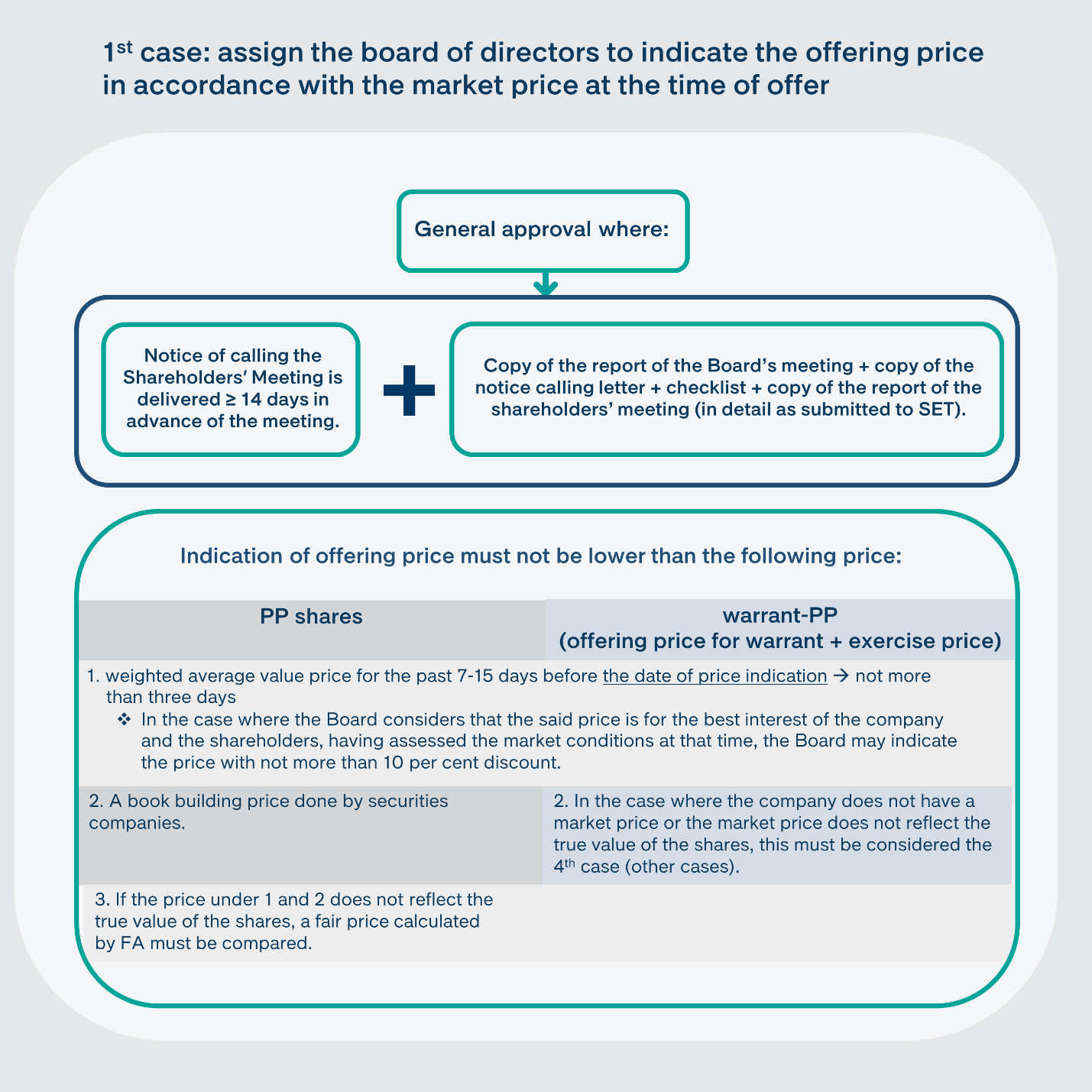

1st case: assign the board of directors to indicate the offering price in accordance with the market price at the time of offer

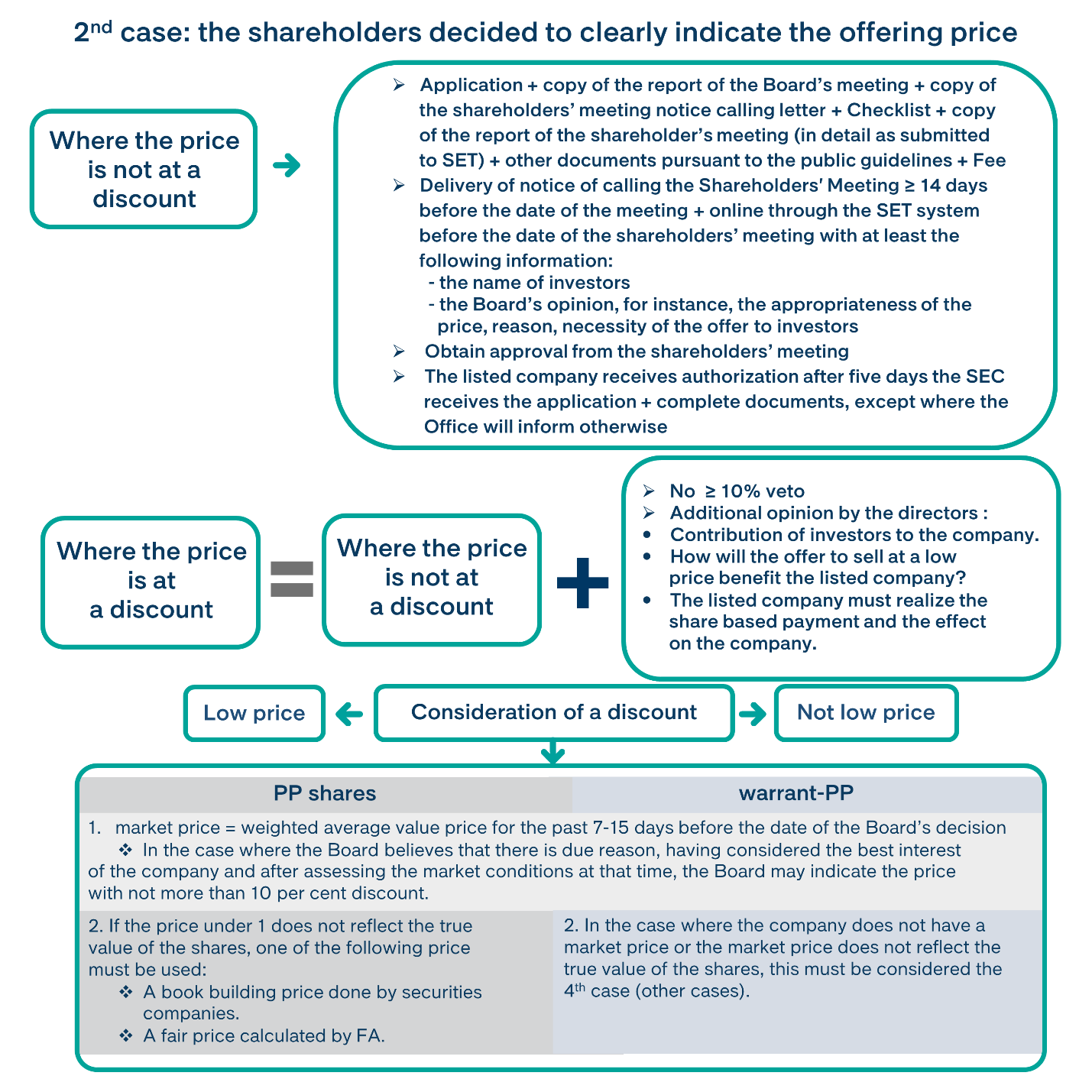

2nd case: the shareholders resolved to clearly indicate the offering price

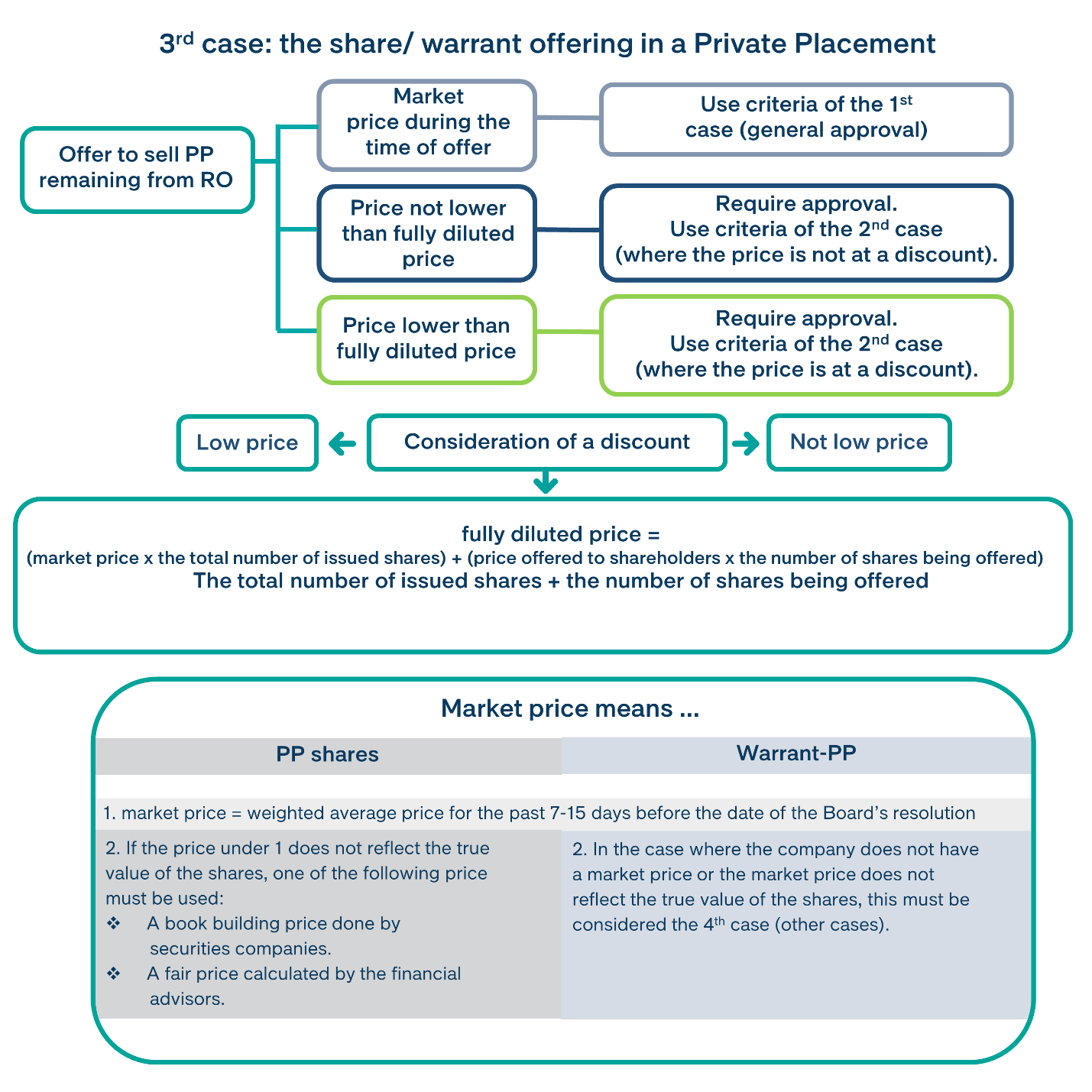

3rd case: the offer to sell shares remaining from Rights offering

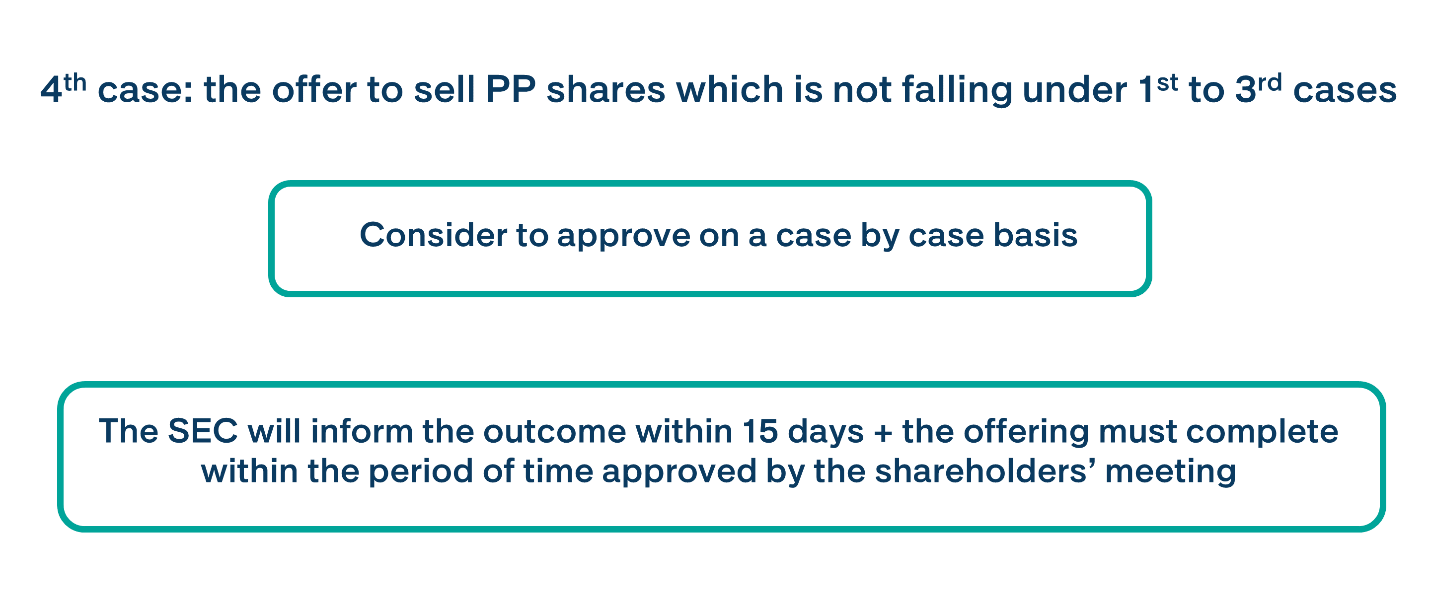

4th case: the offer to sell PP shares which is not falling under 1st to 3rd cases

1st case: assign the board of directors to indicate the offering price in accordance with the market price at the time of offer

2nd case: the shareholders decided to clearly indicate the offering price

3rd case: the share/ warrant offering in a Private Placement

4th case: the offer to sell PP shares which is not falling under 1st to 3rd cases

Conditions for approval

A listed company is prohibited from advertising the offer to sell new shares to the public.

A listed company must use proceeds from the approved offering of shares in accordance with the objectives of the capital increase indicated in the notice calling shareholders' meeting.

A listed company must disclose information about the newly issued shares to PP before the offer to sell, with the details of at least the offering price and the method of calculating the offering price via the system to disclose information as specified by the SET.

A listed company is prohibited from offering shares to a subsidiary.

If the persons being allocated shares are related persons, the listed company must act pursuant to the criteria of related party transactions.

Additional requirements for warrant – PP

Approval for warrant – PP must be registered with transfer restrictions.

In case of an offer to sell warrant – PP which the board of directors is aware of the names of investors and the shareholders resolved to indicate the sale price for underlying shares for warrant – PP, investment agreements must be included in the warrant – PP by specifying transfer restrictions for such warrant – PP.

Disclosure of information

The SEC specifies that issuers in a Public Offering must disclose information to investors, and a good disclosure of information should be free flow, namely, investors should have equal access to information. Information must be accurate, reliable, adequate and timely. In addition, information should be both financial and non-financial which reflects the strengths and weaknesses of the company in order for the shareholders to have complete information in making a decision and have control over the executives in risk management, financial management and business strategy. The securities issuing company must disclose the minimum requirements in a format and within the specified period, and the following information is required:

After offering to sell shares, the company has duty to disclose information in:

Important information that must be disclose are, such as,

Risk factors

Type of operation

Capital structure

Management structure

Related transaction

Evaluation report of the internal control system by Internal Auditor (IA)

Management Discussion & Analysis (MD&A)

Events and factors substantially affecting the operation or financial status of the company in the future (forward looking)

Risk factors

Important points

Disclosed information

Type of operation

Important points

What kind of business does the company, subsidiary, associate company do? Is it a product or a service? From which business is the major income derived?

How is the trend of the industry? Can the company compete with other business competitors?

Are there any restrictions in the company's operation?

Disclosed information

Capital structure

Important points

Who are the majority shareholders that can control the votes?

Is there a check and balance among the majority shareholders?

Are there other securities that may cause dilution effect?

What is the policy for payment of dividends?

Disclosed information

The type of securities being issued and still available, for instance, common shares, preferred shares, debentures or convertible securities, as well as important conditions of securities

Shareholding structure (the first 10)

Shareholder agreements

Policy for payment of dividends (both the company and subsidiary)

Management structure

Important points

Who are the directors or executives? What is the scope of their powers?

Who are the independent directors / Audit Committee (AC) to act for the interests of individual investors?

What is the corporate governance and internal control system?

Disclosed information

Board of directors and executives:

Each committee (name, scope of powers)

AC with the experience in auditing financial statements

Name and title of executives / company's secretary

Selection of directors and executives

Remunerations

Corporate governance (CG) / control of usage of internal information

The total number of staff, number of staff in the main fields, accumulated remuneration, labour disputes (if any)

Anti-corruption

Corporate Social Responsibility (CSR)

Related party transaction

Important points

Does the company have related party transactions?

How are the transactions transparent, equitable, reasonable and beneficial to the shareholders?

Disclosed information

Last period transactions:

Names of related party and their relations

The type and amount of transaction

Whether it is a market price or a fair price

Whether the conditions are in accordance with ordinary business

Necessity and reasonableness / opinion of the Audit Committee

Policy or trend of future transactions

Management Discussion & Analysis (MD&A)

Important points

Reasons for the status and business performance, important events that affect the financial statements

Analytical comparison with the company's past and with other companies in the same industry

Obligations or factors which may affect the company

Disclosed information

Summary of financial information with a three year comparison

Analytical explanation of:

Financial status (assets, liquidity, capital expenditure, sources of capital (debt / equity))

Performance (income and equity of business, expenditure, revenue or special expense, financial cost, the rates of gross profit and net profit)

Important financial ratios

Factors which may affect the financial status and performance

Events and factors substantially affecting the operation or financial status of the company in the future (forward looking)

Important points

Disclosed information

There is certainty that it will happen in the future and affect the performance, such as:

Events, obligations or contracts already concluded and has effect on financial statements being due

Income which may not occur again in the future