Detail Content

Infrastructure Fund

As the country is in focus on development of several infrastructure projects, an Infrastructure Fund (IFF) has been serving as a significant vehicle in driving the country's infrastructure development. IFF provides opportunities for government agencies and private entities involving in infrastructure business to raise funds from investors by offering income-producing projects. The proceeds are capitalized in development of new projects, thereby reducing fiscal burdens and public debts while increasing alternatives and opportunities for investment in the country's infrastructure assets. The government has been supporting the scheme with tax benefits as follows:

exemption of dividend tax for ordinary persons up to 10 years from the fund's registration date (currently, a 10% dividend tax is compulsory and can be paid in the form of withholding tax);

exemption on value-added tax (VAT)/Specific Business Tax (SBT)/stamp duty for transactions of asset transfer to infrastructure funds;

Regulatory Summary

Types of assets for investment

Following 12 infrastructure assets are eligible for IFF investment.

Railway or pipeline transportation

Electricity generation

Waterworks

Roads/express ways/concession ways

Airports/ Airfields

Deep sea ports

Telecommunication, or infrastructure for Information Technology and Communication

Alternative energy

Water management system and irrigation system

Natural disaster prevention system

Waste management system

A Multi-infrastructure project which include multiple infrastructure assets of any types specified in 1 to 11 and subject to following conditions*

* 1. Each infrastructure asset is interrelated, promoting or generating benefits to one another or to a common and/or nearby community.

2. Each asset is generating or expected to generate revenue of not lower than 80% of the total income of the aggregate entity.

Investment categories

An IFF can choose to invest in following categories as deemed appropriate:

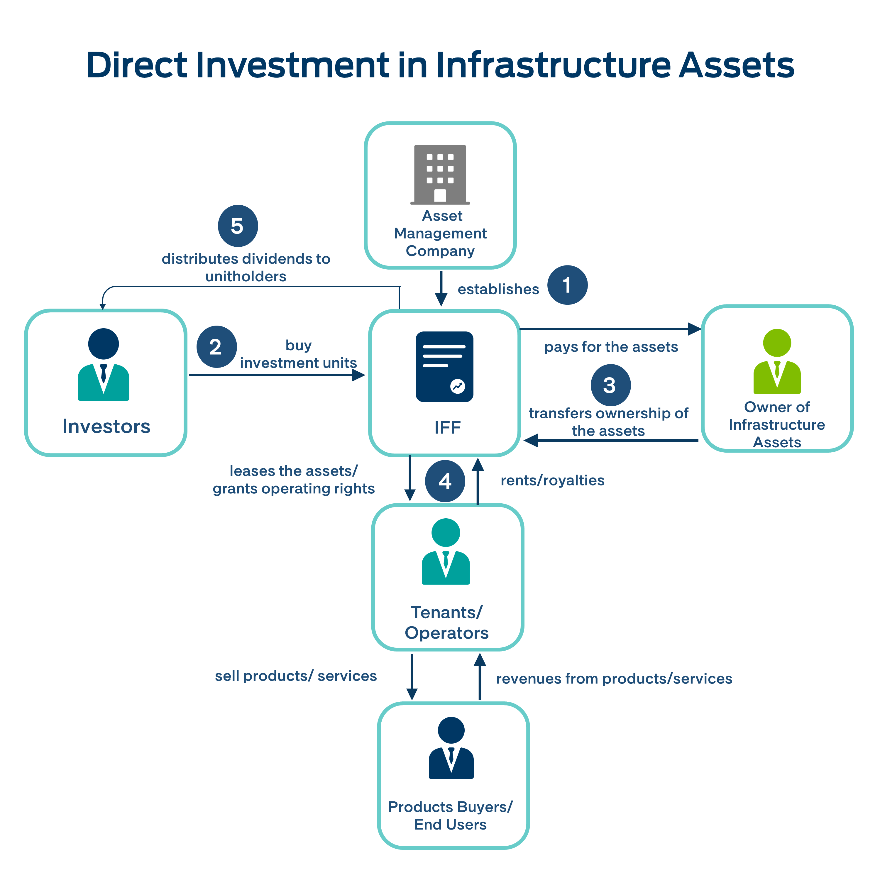

direct investment with ownership in the assets: suitable for infrastructure assets with transferable ownership such as infrastructure of private entities;

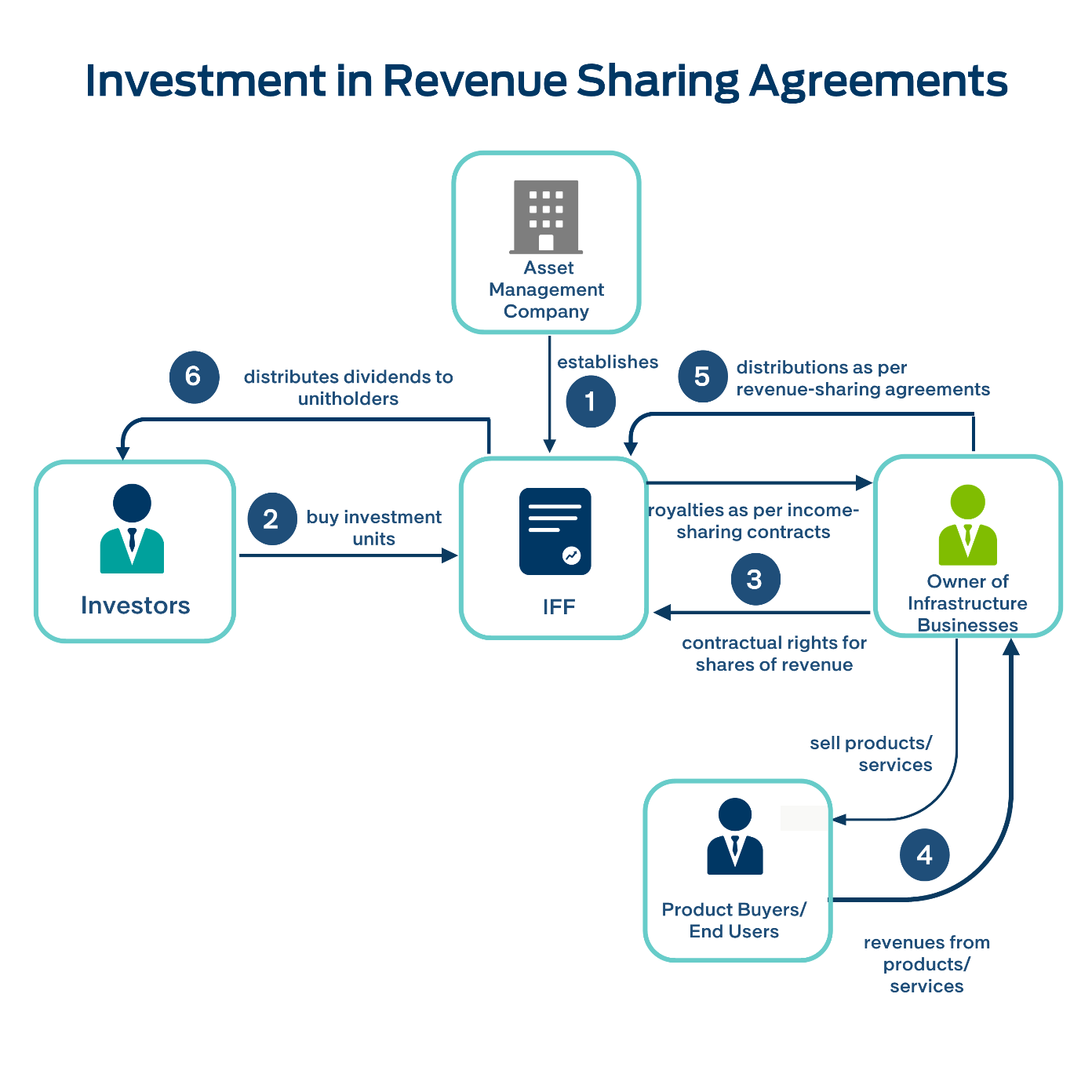

investment in income-sharing or leasehold contracts: suitable for public, non-transferable assets/ concession assets;

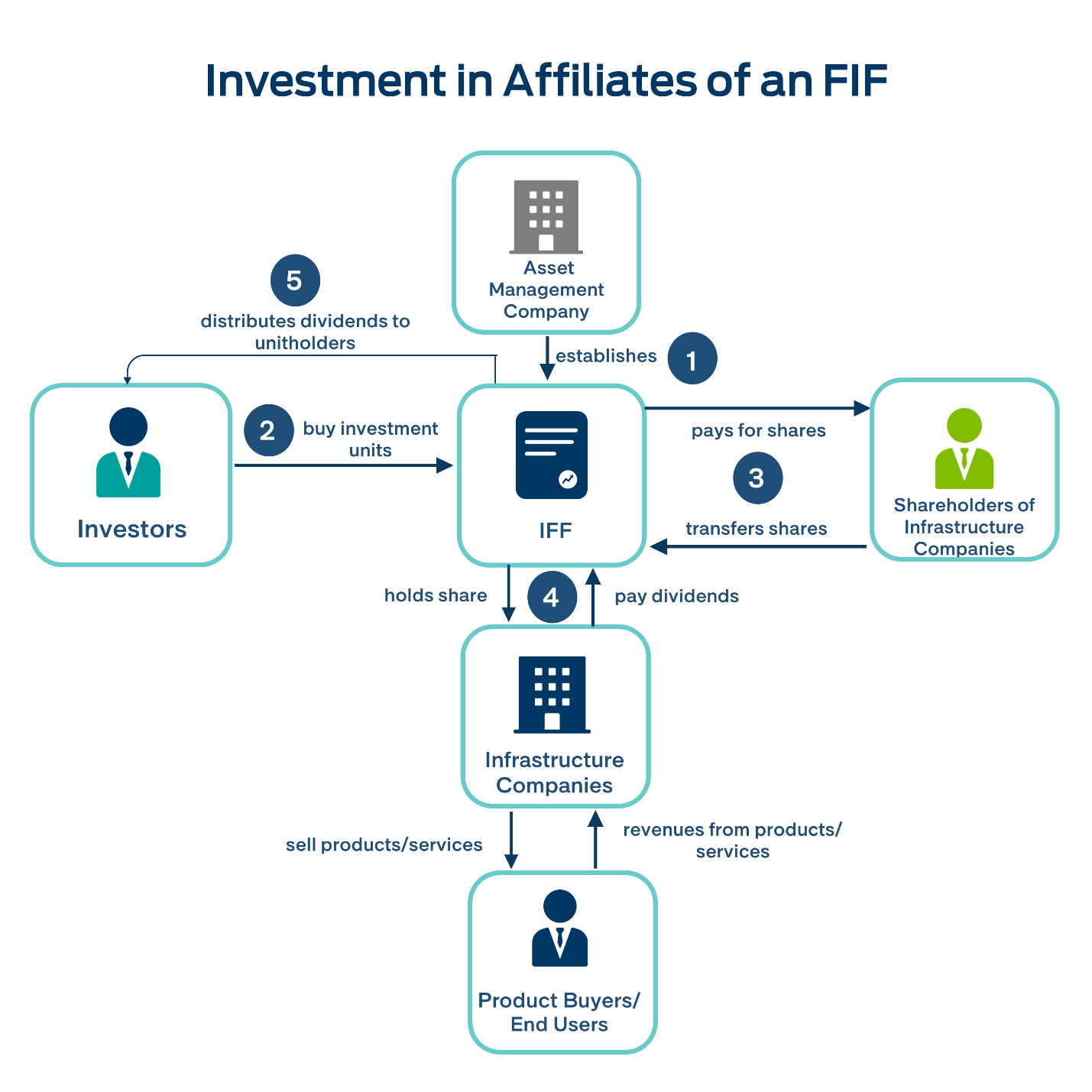

investment through affiliates of an IFF*.

* including lending to subsidiaries.

- Types of investment

- Direct Investment in Infrastructure Assets

- Investment in Revenue Sharing Agreements

- Investment in Affiliates of an IFF

Key features

1. An IFF must raise fund at a minimum of 2,000 million baht.

2. The proceeds shall be for investing in infrastructure assets ≥ 1,000 million baht for each project; except for:

(1) electricity generating business without no minimum limit for project value;

(2) investment in a multi-infrastructure assets shall have investment value in each business ≥ 500 million baht

3. Infrastructure assets to be invested must be aimed at benefitting or providing services to the public at large in Thailand.

The infrastructure entity under IFF shall not sell products/services more than one-third of its

maximum capacity to an individual client, or to a group of associated persons, in case that the

buyers/end users of product/services are not the government agencies. This is not applied on

activities that indirectly contribute to improvement in the public health and welfare, environment

conditions, safety of public lives and assets. |

4. The name of fund shall begin with “Infrastructure Fund" followed by words stating infrastructure activity types under the IFF's investment.

5. An IFF is established as a close-end fund.

6. Infrastructure assets under the investment plan shall be clearly specified in the project details of fund management and in the prospectus.

7. Investments in infrastructure assets ≥ 75% of the total asset value must be done within six months from the date of fund registration;

8. Investments in incomplete projects (greenfield projects) are subject to following conditions:

investment units in greenfield projects ≤ 30% of the total asset value shall be put on offer for sale to 500 retail investors and be listed in the Sock Exchange;

investment units in greenfield project > 30% of the total asset value shall be put on offer for sale to ≥ 35 high net-worth investors (buying investment units at a minimum of 10 million baht). Listing in the Stock Exchange is prohibited before the assets start generating revenue (the listing in the Stock Exchange must be done within three years as from revenue generation).

9. An IFF shall procure commercial benefits from leasing or arranging leasehold agreements with other parties (IFF shall not operate infrastructure businesses).

10. An IFF is allowed for a borrowing ≤ 3 times of the equity and the debt shall be a non-recourse type of debt.

Fund unit holding

An individual or a group of associated persons shall not hold more than one third to the total units*.

An IFF may issue a variety of unit classes (multi-tranche) with different returns. All unit classes must have the same par value and shall not be allocated to any individuals or a group of associated persons over 50% of each unit class.

Investors holding the units exceeding the specified limits shall not be entitled for dividend payment and voting rights.

A foreigner's holding limit is applied as in compliance with the regulations for infrastructure activities under IFF's investment.

* In the case of many sponsors in the fund, the investment units held by all sponsors must not exceed one-third of the total number of the investment units.

Acquisition/disposal of assets/execution or amendment of contracts/ and transactions with related parties

Calculations of transaction sizes and specific actions undertaken as required by related regulations including seeking consents of the trustees, or resolutions of approval by unit holders.

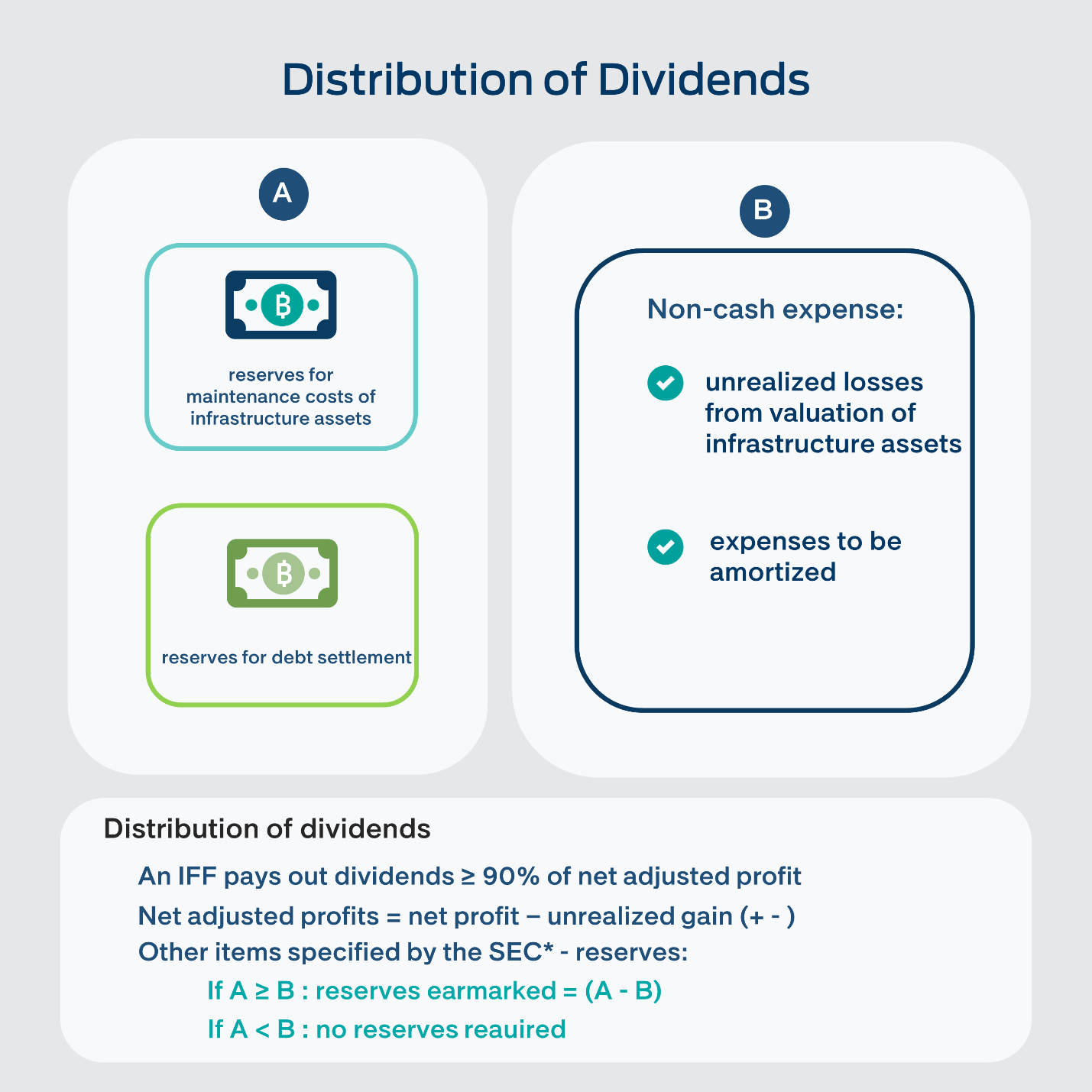

Distribution of dividends

Valuation of infrastructure assets

The codes on valuation of the infrastructure assets under IFF are summarized as follows:

Appraisers: juristic persons with relevant experience/expertise.

A valuation of assets must be carried out in full scale and for public purposes.

An asset valuation must be performed not over one year before buying or selling of the assets.

A valuation is required for infrastructure assets ≥ 50 million baht;

Two appraisers are required for all related party transactions (also applied in the case of buying assets from high net-worth unit holders, or related party with those high net-worth holders);

Asset appraisals shall be renewed at the minimum of every three years after the latest valuation session.

The same appraiser is not allowed to conduct valuation of the same infrastructure projects for more than two consecutive sessions.

In case of any incidents viewed by the asset management company of having material impacts on the value of the infrastructure asset, or upon a request of the trustee or the auditor of the IFF, a revaluation of the asset shall be undertaken without delay.

Information disclosure

An IFF is required to disclose following information:

Asset value, net asset value, and investment unit value of IFF on quarterly basis;

Financial statement-quarterly and annually;

Annual report;

Project progress report, in case of IFFs' investment in greenfield project- semi-annually;

Report in the event of changes that may significantly affect IFFs or as required by the SEC.

Termination of IFFs

Number of unit holders < 35;

An IFF sells infrastructure assets and the asset management company reduces IFF equity to pay to the unit holders, making IFF registered capital < 2,000 million baht (as per par value);

An IFF sells infrastructure assets and the asset management company is not able, within a year, to make the fund having infrastructure assets ≥1,500 million baht and ≥ 75% of the total asset value.

The SEC revokes the approval for establishment of IFF.

Related Rules and Regulations