Limitations on Unitholding over One-Third of Outstanding Units

The purpose of the restriction on unitholding in mutual fund above one-third of the outstanding investment units is to promote the more extensive distribution of investment units. The investment units shall not be concentrated in the holding of any individuals or any groups of persons which could exercise power over fund management and exploit the fund for own benefits such as tax avoidance.

Summary of regulations

1. Limitations on unitholding over one-third of the total outstanding units for any person or any Associated Person. The restrictions are exempted in the following cases:

2. Rules for considering Associated Persons

3. Procedure to comply with the limitations (the case of holding more than one-third of total outstanding units over one year)

4. Procedures for holding investment units over One-Third Limit

1. Limitations on unitholding over one-third of the total outstanding units for any person or any Associated Person. The restrictions are exempted in the following cases:

1.1 No limitation of holdings:

(1) Tax-exempted institutional investors operating as a Collective Investment Scheme (CIS) such as the Government Pension Fund, Social Security Fund, Provident Funds, and retail mutual fund;

(2) Tax-exempted juristic persons under Thai laws such as Government Saving Bank, foundations or monasteries, and the like;

(3) Investors in the investment units of ASEAN CIS offered for sale overseas with foreign nationality (normal persons/juristic persons) or via omnibus account under a foreign mutual fund management company.

1.2 Relaxation on the unitholding proportion with condition under the following cases:

(1) In the case of unitholding in ETF by the Participating Dealer( PD)/Market Maker (MM) as appointed by the mutual fund management company;

(2) A retirement fund (RMF) receiving proceeds transferred from provident funds (PVDs) or other RMF;

(3) Other cases of unitholding for a consecutive period of not over one year, except that the SEC has granted a relaxation as deemed necessary and reasonable.

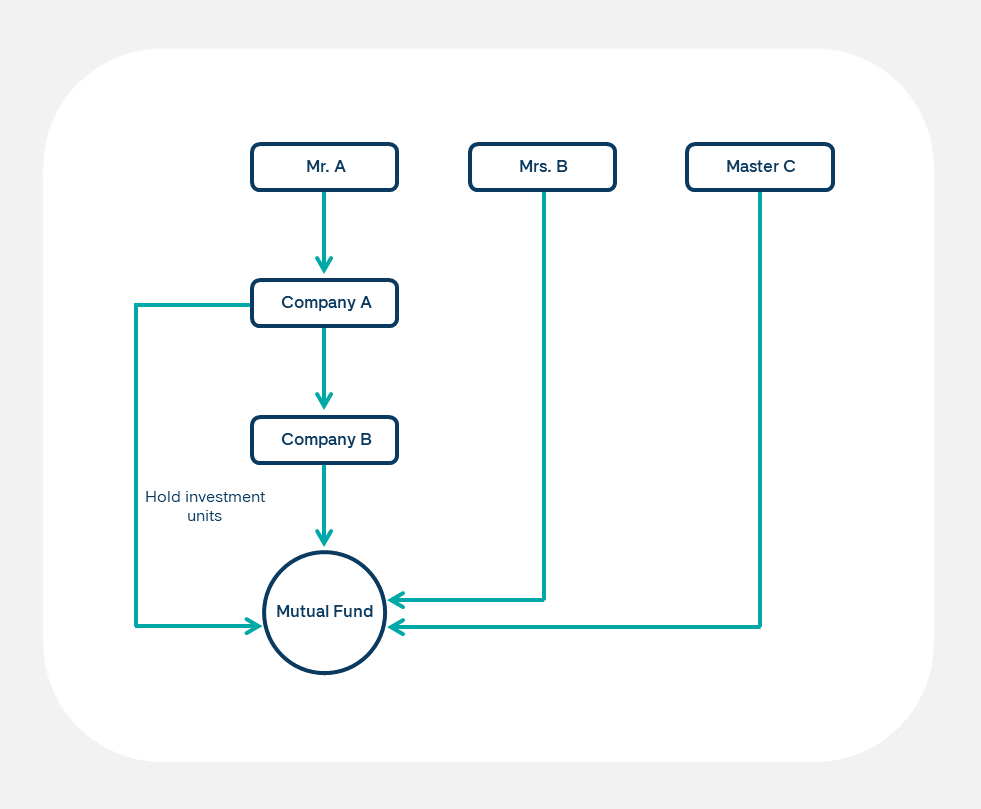

2. Rules for considering Associated Persons

2.1 In the case of normal persons: the unitholders, the spouse and children not becoming sui juris, and the private fund of such persons.

2.2 In case of juristic persons: including unitholders and

(1) A juristic person and a shareholder or a partner of the said juristic person who holds shares or partnership in such juristic person, either directly or indirectly, more than fifty percent of the total sold shares or the total partnerships;

(2) A private fund or unitholders of the

persons in (1).

3. Procedure to comply with the limitations (the case of holding more than one-third of total outstanding units over one year)

Actions to be taken to comply with the “one-third" rule:

Any person shall not hold investment units exceeding one-third of the total sold units of the mutual fund for longer than one year.

In the case of no relaxation of holding more than one-third of investment units, the mutual fund management company shall:

(1) Notify the unitholder registrar to acknowledge the limitations on unitholding and monitor the unitholder registrar to reject a transfer of investment units that will violate the rule.

(2) Examine the unitholding proportion of any person or Associated Person in each mutual fund to comply with limitations on unitholding and let the Selling agentsexamine and report to the mutual fund management company where noncompliance with limitation on unitholding has been found. (an exception case shall be specified).

4. Procedures for holding investment units over One-Third Limit

Where any person or Associated Person hold investment units over one-third of the units outstanding, directly or indirectly, possibly from causes such as increasing investments, obtaining a waiver as an eligible case specified above, or any actions in good faith that do not include increases in investment, the mutual fund management company shall take following actions:

| Excess from Increases in

Investments

| Excess from obtaining

exemptions

| Excess from operations in good

faith

|

Report to the SEC within five

business days as from the date on which the mutual fund management company

knows, and the report shall contain a corrective measure. | /

| X

| X

|

The votes

of the excess units over one-third shall not be counted * | /

| /

| /

|

Pay dividend in the total

amount | X

| /

| /

|

Correct the proportion within two

months | /

| X

| X

|

Disclose information to the

public | /

| /

| /

|

* Except the cases of exceeding one-third limit from investment in ASEAN CIS. All votes there of can be counted according to the proportion of holding in the ASEAN CIS.

Related Regulations