Detail Content

Infrastructure Trust

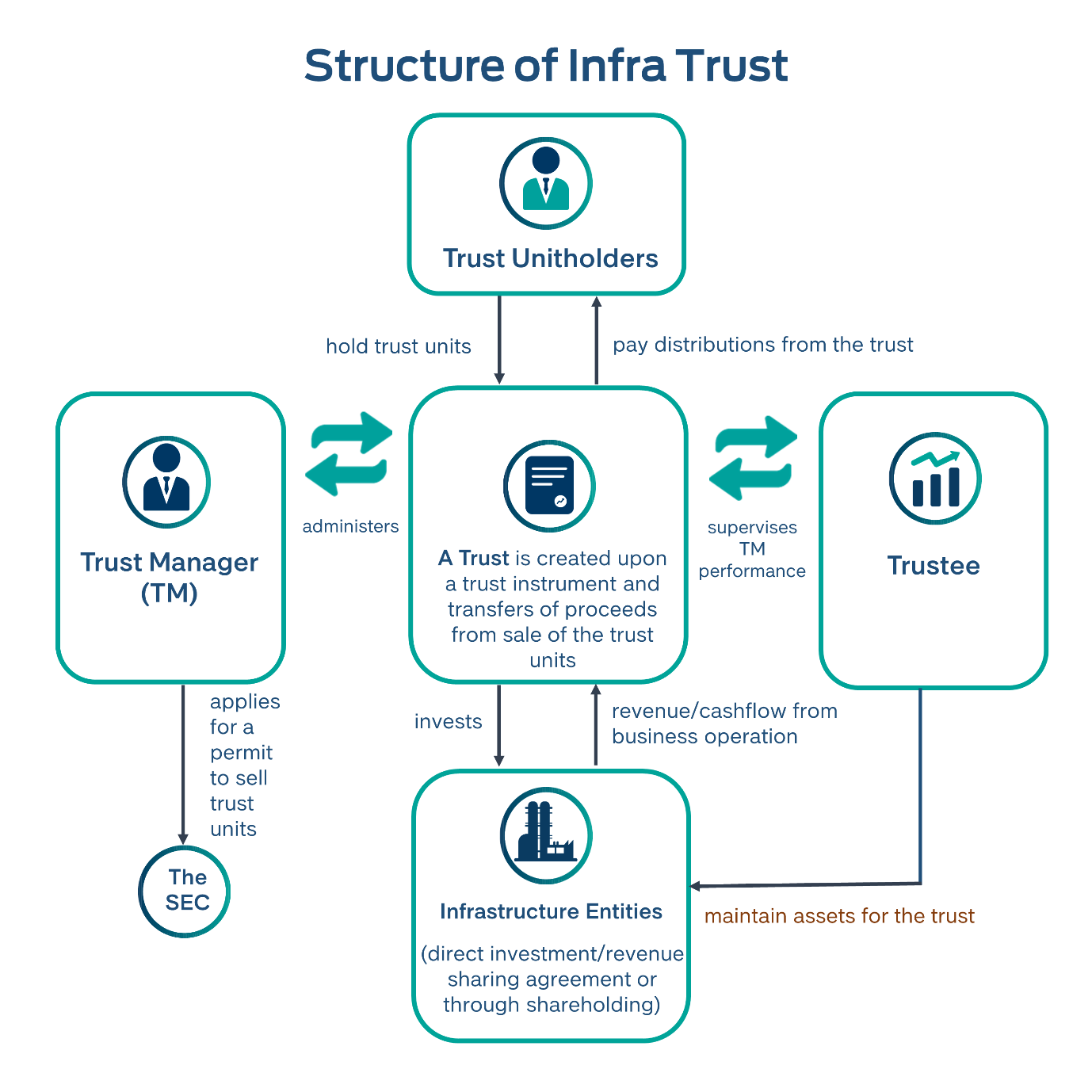

An Infrastructure Trust (Infra Trust) is a fund mobilizing tool for an investment in infrastructure activities using a trust as a vehicle.

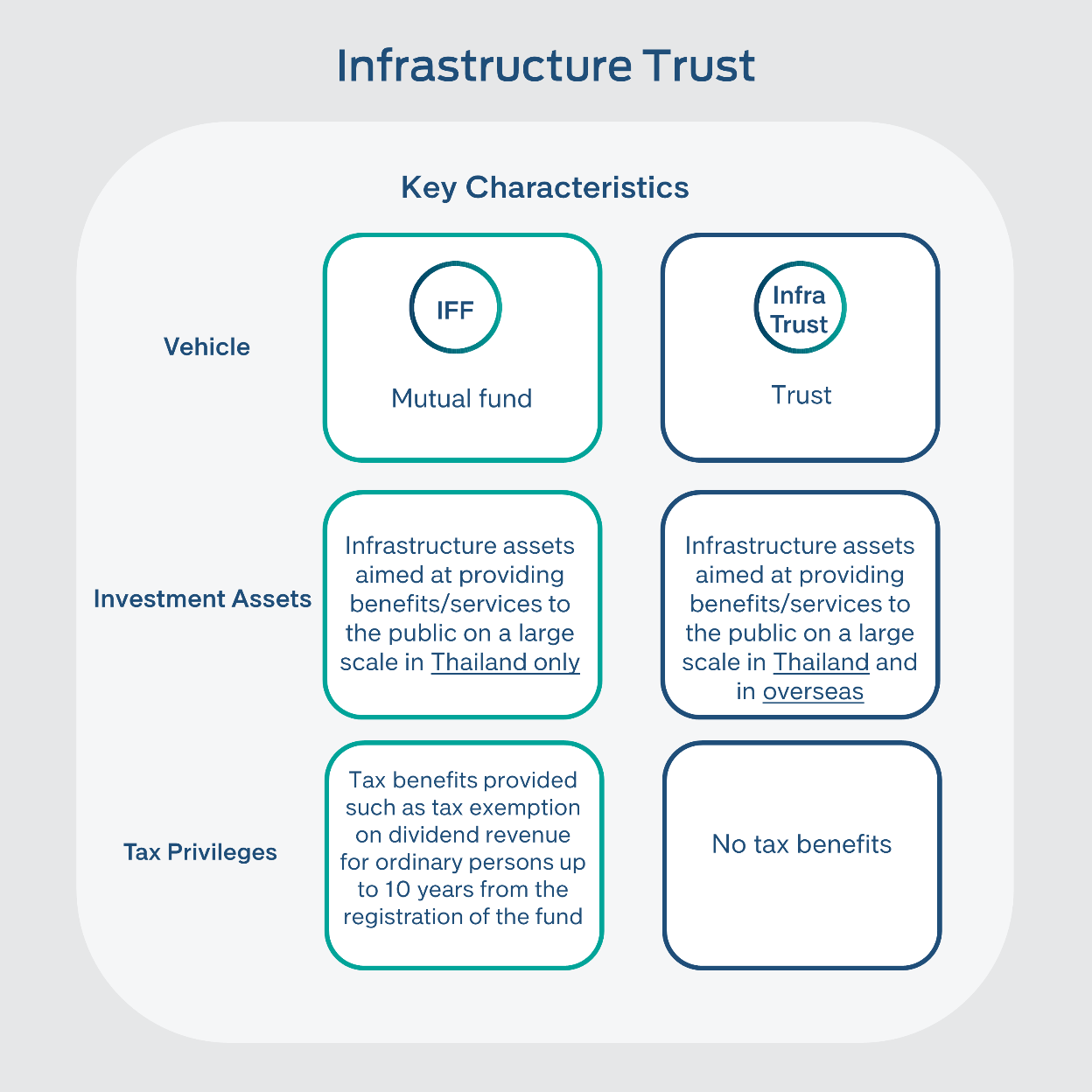

An Infra Trust serves not only as a fund mobilizing alternative for the public and private sectors but also an investment choice for all types of investors. The following diagram summarizes discrepancies and similarities of an Infrastructure Fund (IFF) and Infra Trust.

The major rules

Minimum mobilized capital of 10,000 million Baht.

Minimum asset value for each project of 3,000 million Baht.

Investment locations: unlimited (Thailand included).

Qualified infrastructure assets for investment: the same criteria as applied for IFF.

In case the combined value of the completed, income-producing projects (Brownfield), and the incomplete projects (Greenfield)* <= 30% of the total net asset value of the Infra Trust, the trust can sell units to high net-worth investors or general investors (in case of selling to retail investors, listing of the units in the Stock Exchange is required to enhance the liquidity).

In case the asset value of Greenfield* projects > 30% of the total asset value of the Infra Trust, a sale offer shall be made only to high net-worth investors (purchasing trust units ≥ 10 million Baht)

Investment in infrastructure assets directed for benefitting the public on a large scale (the same consideration criteria as applied for IFFs, mutatis mutandis)

*Greenfield herein refers to infrastructure projects which have not yet generated commercial revenue.

Investments in infrastructure assets Three Types of qualified investments are:

direct investment through obtaining ownership of assets: suitable for infrastructure assets with transferable ownership such as private sector's infrastructure;

investment in revenue sharing, leasehold agreements: suitable for the public assets and non-transferable ownership/concessions;

investment in subsidiaries of infra trusts (holding shares at a minimum of the supermajority proportion required by the country in which the company is established. In case of any restrictions, sharing holding shall not be less than 40% of the voting rights).

A Trust for high net-worth investors vs retail investors

Key provisions in the regulations governing Infra Trust regarding high net-worth investors and retail investors are summarized as follows:

Subjects | High Net-Worth Investors | Retail Investors |

1. Application for sale of the units and submission of the filings | the offeror + FA together submit the application and certify the correctness of information provided. |

2. Listing in the Stock Exchange | no restrictions | listing in the Stock Exchange is required |

3. Offer for sale through an underwriter | no restrictions | with restrictions |

4. Restrictions for unit holdings | - any persons or a group of the associated persons not more than 50% of the total trust units sold. - trust manager can allot units for the trust manager, directors, executives, major shareholders, subsidiaries and related persons, provided that the allotment proportion is disclosed clearly in the filings |

5. Asset valuation | no restrictions | - the appraisers have experiences + expertise in valuation of infrastructure assets; - a renewal of asset valuation is required every three year |

6. Unit holder meetings | no restrictions | a yearly unit holder meeting is mandatory, a resolution of unitholders shall be sought through an organized meeting |

7. Leveraging (including issuing of debt instruments) | no restrictions | not more than three times of the equity (the same as applied for IFFs) |

8. Information disclosure |

| information disclosure at the minimum as specified by law | the same criteria as applied for IFFs |

- information disclosure as per section 56

| no discrepancies

|

| based on Thailand accounting standards and audited by approved auditors |

9. Related Party Transactions (RPT) / acquisitions/ dispositions of assets | no restrictions | subject to transaction sizes |

10. Return payment | > = 90% of net profit |

11. Establishment contract of a trust (a Trust Deed) | at a minimum as specified by laws + restrictions in transfer of trust units | with provisions in more details |

Termination of a trust

When a trust sells off the infrastructure assets and is unable to increase the investment to bring to net asset value to be equal to or higher than 75% of the minimum net asset value required by laws, which is not below 7,500 million Baht, within one year from the date of selling the infrastructure property.

When trust unitholders pass a resolution to dissolve the trust.

In case of trusts for retail investors, the number of unitholders falling below 35 can be a cause for dissolution of the trusts.

The SettlorA Trust Manager is the settlor of the trust. The settlor can either be an asset management company or a non-asset management company:

obtaining approval by the SEC, and being in readiness of work systems and staffs;

in case of a non-asset management company, additional qualifications are required such as a paid-up capital of not less than ten million baht, having at least one-third of independent directors, a least two Thai-national directors (one in these two directors must be an independent director)

Trustee's duties

A trustee shall have a trustee license and is independent from a trust manager. A trustee's main duties are to:

oversee that the trust instrument is established in conformity with relevant laws;

appoint a trust manager;

prepare a trust property account in segregation from a trustee account;

ensure that the units are not allocated to investors who are not high net-worth, in case of offer for sale solely to high net-worth investors;

oversee to prevent the trust from becoming a private trust;

perform duties as required by laws and provisions set out in the trust instrument.

Related Rules and Regulations