Detail Content

Group 1: Information disclosure that may cause damage to investors and capital market

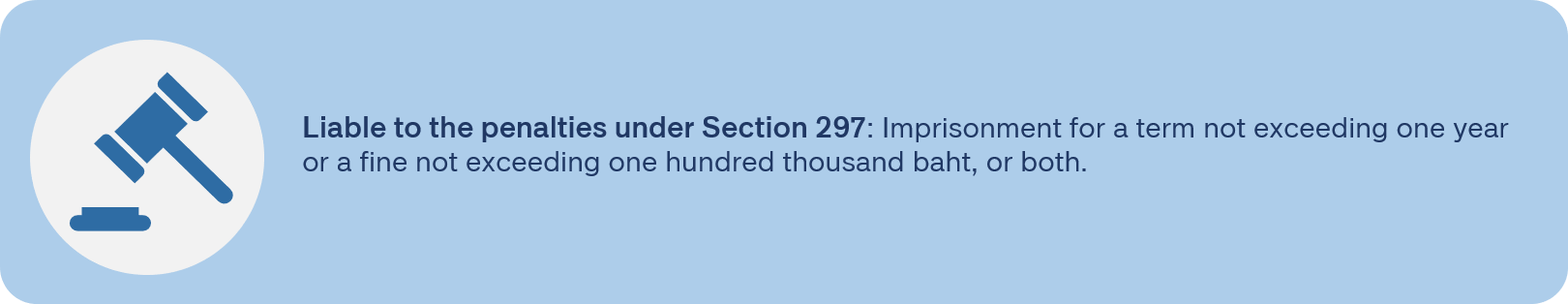

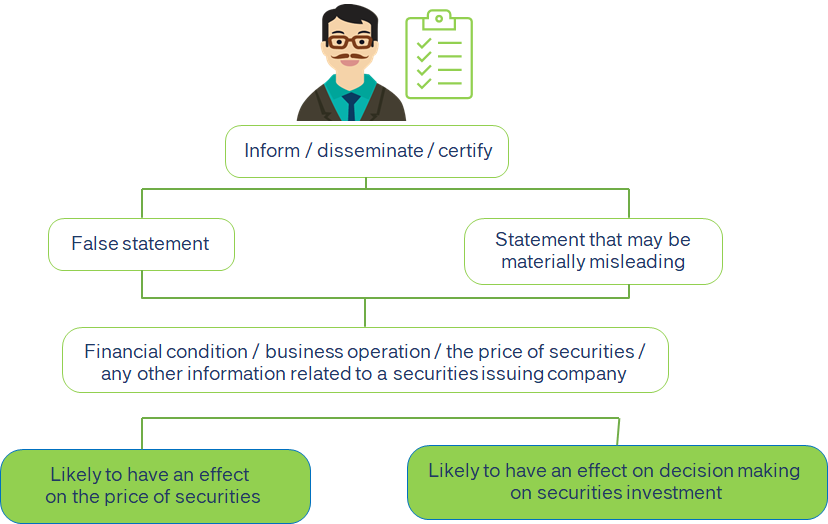

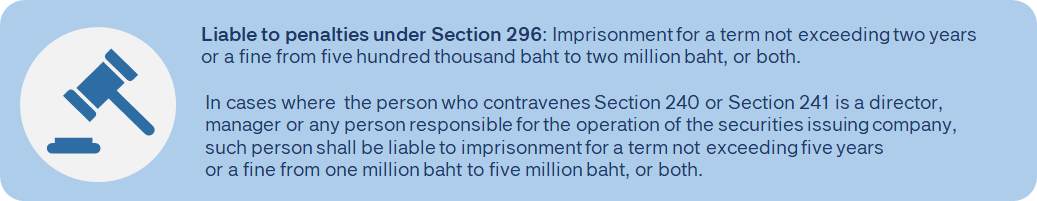

1.1 Inform, disseminate, or certify any statement of information that is materially misleading (Section 240)

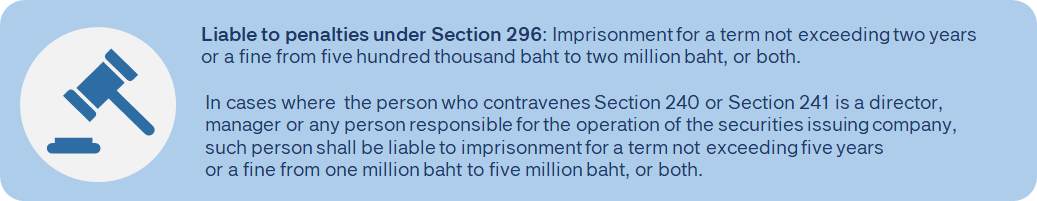

1.2 Analyze or forecast by using false information or distorting information (Section 241)

Group 2: Constituting an unfair advantage over investor by exploiting the inside information

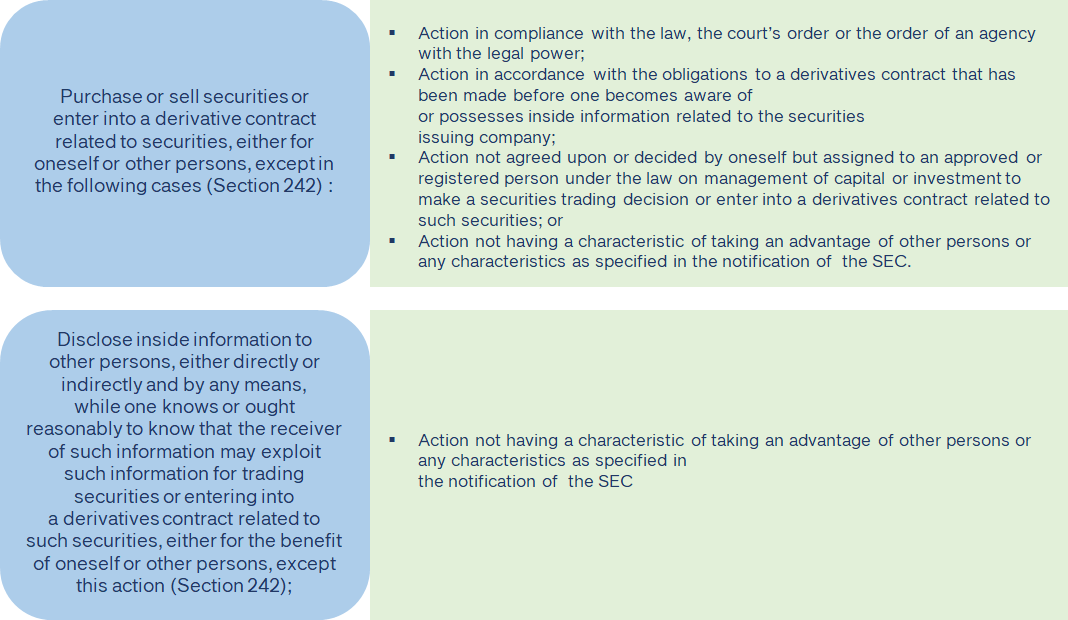

2.1 Trade securities by using inside information (Section 242)

Offender | Person who knows or possesses inside information related

to a securities issuing company

|

Nature of the acts | Purchase or sell securities or enter into a derivatives contract related to securities, either for oneself or other persons Disclose inside information to the other persons, either directly or indirectly and by any means, while one knows or ought reasonably to know that the receiver of such information may exploit such information for trading securities or entering a derivatives contract related to such securities, either for the benefit of oneself or other persons

|

Inside information means information that has not been generally disclosed to the public and is material to the change of price or the value of securities.

Presumption on person who “knows or possesses inside information" | Acts |

Insider (Section 243) (1) Director, executive or controlling person of securities issuing company (2) Employee or worker of a securities issuing company who holds a position, or is in the line of work, is responsible for or capable of accessing inside information; (3) Any person who is able to know inside information by performing duties as auditor, financial advisor, legal advisor, asset appraiser or any other person whose duties are related to inside information, including employees, workers or colleagues of the aforesaid persons who hold a position or is in the line of work involved in the performance of duties related to such inside information; (4) Director, sub-committee member, representative of a juristic person, agent, worker, employee, advisor or operator in a governmental agency, the SEC Office, the Securities Exchange, the over-the-counter center, or the Derivatives Exchange, who is in the position or the condition that can access inside information through performance of duties; (5) Juristic person whose business is under control of the persons under (1) (2) (3) or (4). | Trading / disclosure while possessing inside information

|

Presumtion on persons, who trade securities or enter into a derivatives contract in a different manner from their normal practice while know or possessing inside information

(Section 244) (1) Holder of securities exceeding five percent of the securities issuing company's total securities sold, including the securities held by spouse or cohabiting couple and minor children of the securities holder; (2) Director, executive, controlling person, employee, or worker of business in the group of the securities issuing company, who holds a position or the line of work responsible for or capable of accessing inside information; (3) Ascendant, descendant, child adopter, adopted child of the persons under Section 243, sibling of the same blood parents or sibling of the same blood father or mother of the persons under Section 243; (4) Spouse or cohabiting couple of the persons under Section 243 or the persons under (3)

| Trade securities or enter into a

derivatives contract in a different manner from their normal practise while know

or possessing inside information

|

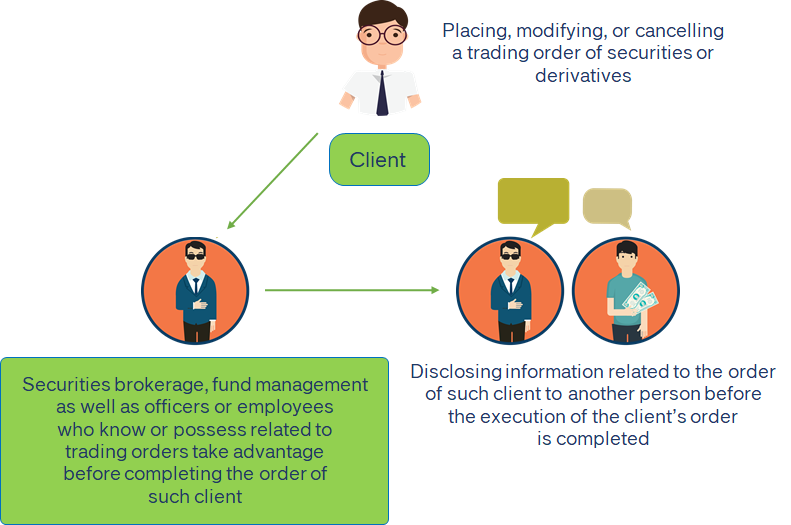

2.2 Securities

trading by taking advantage of the information related to a trading orders of

securities or derivatives of any client before completing the order of such

client (Section 244/1 and Section 244/2)

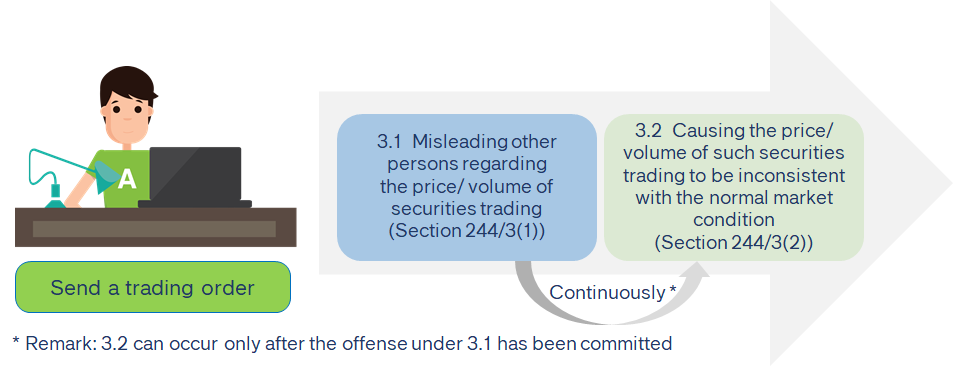

Group 3: Securities Price Manipulation

3.1 Securities trading in such a way that misleads other persons regarding the price or volume of the securities trading (Section 244/3(1))

3.2

Securities trading on a continued basis with an intent to cause the

price or the volume of such securities trading to be inconsistent with the

normal market condition (Section 244/3(2))

1. Purchasing or selling securities in such a way that does not involve a change of beneficial ownership of such securities; 2. Placing a securities purchasing order while being aware that oneself or an associate has made an order to sell the same securities or will do so at a similar amount and a similar price within a similar period of time; 3. Placing a securities selling order while being aware that oneself or an associate has made an order to buy the same securities or will do so at a similar amount and a similar price within a similar period of time; (4) Placing, modifying, or cancelling a securities trading order during the pre-opening or pre-closing period of the Securities Exchange or the over-the-counter center, as the case may be, with an intent to cause the opening or closing price of such securities to be higher or lower than it should have been; 5. Placing, modifying, or cancelling a securities trading order in such a way that obstructs securities trading of other persons, which causes other persons to place a trading order at a higher or lower price than it should have been.

| 1. Trading of securities for price stabilization under the underwriting agreement with the securities issuing company and in compliance with the regulations issued by the Capital Market Supervisory Board under this Act; 2. Repurchasing of shares or selling of the repurchased shares in the share repurchase project in accordance with the regulations issued by the board of directors of the Securities Exchange under this Act; 3. Purchasing or selling of securities in accordance with the rule, conditions and procedures as specified in the notification of the SEC.

|

Acts presumed to be done by an associate in securities price manipulation (Section 244/6)

|

1. Opening a joint bank account for making a payment or receiving a payment related to or because of a securities trading; 2. Allowing any person to seek benefits by using one's own bank account for making payments or receiving payment related to or because of securities trading; 3. Allowing any person to use one's own securities trading account; 4. Making a payment or receiving a payment for a securities trading for any person; 5. Placing money or other assets as collateral for securities trading of any person; 6. Allowing any person to receive benefits or oversee payment related to or because of one's own securities trading; or 7. Transferring or receiving a transfer of securities between each other.

|

Group 4: Other related cases

4.1 Placing,

modifying or cancellation a securities trading order through the securities

trading system of the Stock Exchange or the over-the-counter center even though

it is known or ought reasonably to be known that such act is likely to cause

the price or volume of securities trading to be inconsistent with the normal

market condition and cause the securities trading system to delay or discontinue (Section 244/7)

4.2 Using another person's securities trading account or a bank account of payment of securities trading to conceal the identity of the account user/ to commit an unfair act regarding securities trading (Section 297)