Wealth Advice for All

Thailand is presently stepping into an aging society, but most Thai people do not have enough savings at their retirement. Evidently, over a half the members of the provident funds receive less than one million baht at the retirement. For a number of Thai people, despite their needs for advisory services of financial planning to attain targeted savings, do not have access to these services. The existing advisory services are catering primarily to high net worth investors. Some salespersons of financial products focus on sales figures and brokerage commissions, giving less importance on recommending products suitable for investors' risk tolerance and their long-term investment goals. This may lead to multiple financial products in the investors' portfolios but insufficient solutions to the investors' long-term financial well-being.

The SEC is proceeding with a strategic plan to urge the Thai public to realize the importance of financial planning to really and to put into practice. In parallel, we support service providers of financial planning accessible by the general public. Furthermore, we encourage uses of FinTech to generate financial solutions, and to serve as an aiding tool for financial planning under the framework “Five Steps to Investment with Confidence".

1. A juristic person with a license for operating securities or derivatives businesses

2. In readiness for providing services such as having capital and staff capacities to offer services appropriately and sufficiently, operating on an information technology system with efficiency and security

3. Having a complete process of client contact and services in the five steps as follows:

1) exploring and understanding customers

2) constructing an investment portfolio

3) implementing the portfolio according to the asset allocation plan

4) monitoring and rebalancing the portfolio

5) providing consolidated reports for clients' review

4. Equipped with an electronics platform in rendering services. An arrangement of knowledgeable and competent staffs is required for taking part in determining processes and factors to select products on the platform. The advisory process should be carried out based on theoretical principles and include measures to manage conflicts of interest effectively.

5. Clearly segregating the unit of trading function from the unit responsible for defining factors for product selection.

6. Implementing a renumeration structure that does not tie up solely to sales KPI, for the personnel the wealth advisory function.

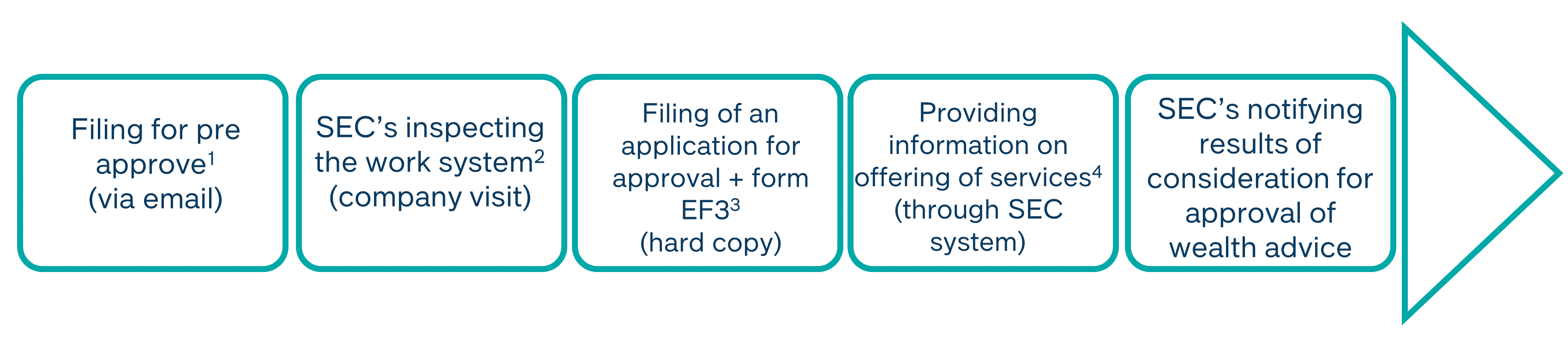

- Steps of Applying for approval

Notes

1. Filing forms for pre-approval can be requested and submitted at tanyanan@sec.or.th / pornpong@sec.or.th

2. The SEC will make an appointment for an on-site inspection of the work system

3. Filing the original documents:

3.1 Download an application form for approval of wealth advisors from the SEC's website. Make corrections in the form as advised by the SEC after the inspection of the work system. Submit the original application+ supplement document to the SEC

3.2 Download and look into an example of completed form EF-3, a letter of acceptance in delivering information and of appointing operating officers at www.sec.or.th/ca . For any inquiries, contact tel: +66-2263-6253. An original completed form EF-3 can be submitted to the SEC before the filing the original application for approval

4. Submit activity reports on wealth advisory operation (particularly item 4.1) to the SEC, so that the SEC can use to publicize the services via SEC website and other media (by logging into the system as notified via SEC e-mail, after approval of EF-3). Thereafter, submission of following reports will be required at specific time periods:

4.1 An activity report on wealth advisory services (annually)

4.2 Investment reports (quarterly)

Related Rules and Regulations

The Notification of the Office of the Securities and Exchange Commission No. SorThor 31/2561 Re: Rules in Details on Wealth Advisory Service Business

The Notification of the Office of the Securities and Exchange Commission No. GorNor 13/2561

Re: Ruling on Portfolio Management Services by the Approved Wealth Advisors not Considered a Securities Finance Business in the Category of Private Fund Management

The Notification of the Office of the Securities and Exchange Commission No. GorMor 14/2561

Re: Fees for Operating Licensed Business Activities (No.5)

The Notification of the Capital Market Supervisory Board No. ThorLorThor. 46/2561 Re: Regulations for Personnel in the Capital Market Business (No. 9)

Related Forms