AGM FAQ

Before the meeting

During the meeting

After the meeting

Record date

Before the meeting

Q: In case that a shareholder or shareholders who holds an aggregate amount of at least 5 percent of the voting shares submits a written proposal to request an item be added to the agenda of the shareholders' meeting but the company does not comply even though the shareholders holding more than one third of the total shares sold have voted for the proposal, can such proposed agenda item be considered at the current meeting instead of being postponed until the following year?

A: Pursuant to Section 89/28, a proposal for additional agenda item before the shareholders' meeting commences does not deprives the shareholders of their rights under Section 105 of the Public Limited Companies Act, provided that the shareholders holding at least one third of the total shares sold propose that the meeting consider such additional agenda item. However, it must wait until the consideration of the preceding items has been completed.

Q: In case a shareholder holding at least 5 percent shares has proposed an agenda item but whose name does not appear in the register at the record date, should the board of directors nevertheless include the proposed agenda item in the shareholders' meeting?

A: In principle, a proposal for consideration of an agenda item is valid on the condition that the person who makes the proposal is a shareholder on the submission date and has the right to attend the shareholders' meeting (if his or her name appears in the register on the record date).

Q: Is the resolution of the board's meeting required in the case that the board of directors refuses to include the agenda item proposed by a shareholder or shareholders holding an aggregate of at least 5 percent of the total voting shares? In addition to notifying the shareholders in accordance with Section 89/28, is the company required to notify the SET accordingly as well?

A: Pursuant to Section 89/28, the rejection of an agenda item proposed by the shareholders must be a resolution of the board of directors. In this regard, the SET regulation on information disclosure requires that listed companies notify the board's significant resolutions within the following business day after such resolutions have been passed.

Q: In case a listed company suggests that the shareholders who cannot attend the shareholders' meeting give proxy to an independent director to vote on their behalf, is it considered a general solicitation? And must the voting guidelines of such independent director be notified?

A: Pursuant to Section 89/31, a listed company's proposal of proxy voting by an independent director is considered a general solicitation. Nevertheless, the Capital Market Supervisory Board has not issued a notification prescribing the rules, conditions, and procedures for this matter. In any case, the company should provide information related to such independent director, e.g., any conflict of interest regarding the matters in the agenda.

Q: In what cases is a listed company required to send the shareholders' meeting notice at least 14 days prior to the meeting date?

A: Normally, the company must send the shareholders' meeting notice at least seven days prior to the meeting. However, in cases where the shareholders' approval is required – e.g., private placement of shares, warrants, or convertible debentures at a price lower than the market price, ESOP, related party transactions, acquisition and disposal of assets – the shareholders' meeting notice must be delivered at least 14 days before the meeting.

Q: Is a nominated director who is also a shareholder allowed to attend the meeting and vote on the appointment of directors?

A: Yes. Pursuant to Section 102 in conjunction with the second paragraph of Section 33 of the Public Limited Companies Act, a nominated director has the right to attend the meeting and vote for oneself.

Q: Can the shareholders' meeting be held at the company's plant located far off or in a provincial area?

A: Pursuant to Section 101 of the Public Limited Companies Act, the venue of the shareholders' meeting must be in the locality where the head office of the company is located or in a nearby province unless specified otherwise in the Articles of Association. Therefore, if the Articles do not specify the meeting venue, the company may hold the shareholders' meeting at its plant or a nearby location. However, to demonstrate that the company supports the shareholders' participation and exercise of the voting right, the company should make it convenient for the shareholders to do so by, for example, providing transportation services.

Q: If the shareholders' identification is unclear, can the company disallow their meeting attendance?

A: The company should clearly specify such condition and inform the shareholders in advance together with the meeting notice.

During the meeting

Q: In case the meeting fails to constitute a quorum and consequently must be rescheduled, would the existing shareholders' list still apply or must it be updated upon closing the register again?

A: In case of closing the register in accordance with Section 60 of the Public Limited Companies Act, the company should consult with the Ministry of Commerce regarding the proper procedure for the matter.

Q: How should the company deal with troublesome shareholders or those who dominate the question by excessively demanding detailed answers on a minor matter?

A: The meeting's chairperson should politely ask the shareholders to post further inquiries on the matter of their concern after the meeting to allow other matters on the agenda to be considered for the sake of all shareholders'.

Q: Is it the power of the Stock Exchange of Thailand and the Securities and Exchange Commission to order a listed company to reschedule its shareholders' meeting if the company adds a new significant matter to the agenda during the meeting, e.g., a related party transaction or a capital increase/decrease?

A: Neither the Stock Exchange of Thailand nor the Securities and Exchange Commission has the legal power to issue such order; however, the SET or the SEC may take other measures, for example, posting the trading suspension sign or blacklisting the director(s) or executive(s) for allowing such inappropriate and unfair act to happen during the meeting.

After the meeting

Q: In case the meeting prolongs beyond schedule and reservation agreement with the hotel venue, is the company allowed to request the shareholders to post further inquiries and/or attend a Q&A session later after the meeting has ended?

A: The company may do so but only when all of the matters specified in the meeting notice have been considered completely in accordance with Section 105 of the Public Limited Companies Act. Otherwise, another meeting must be held to complete the consideration of the remaining matters in the agenda. If the Q&A session is already in process, it is acceptable to ask the shareholders to continue with their inquiries after the meeting has ended.

Q: What should the effective minutes of the shareholders' meeting contain?

A: The minutes should contain a complete record of significant issues discussed at the meeting, including the voting method, the voting results of each matter (with details of approval, disapproval, and no votes). Especially regarding related party transactions, the names of the shareholders without the voting right and the number of their shares must be clearly identified. Information on significant inquiries and opinions should be recorded for future reference as well.

Record date

Q: what is the difference between the record date and the closing date of the register?

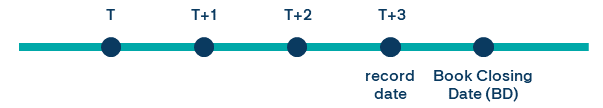

A: The record date is the date set by the board of directors wherein the shareholders whose names appear in the register are entitled to certain rights, e.g., the rights to attend the shareholders' meeting, to receive dividends or to buy capital shares. The record date allows listed companies to send the shareholders' meeting notice much ahead of time; normally the register must be closed for share transfer 21 days before the meeting date pursuant to the Public Limited Companies Act whereas the record date allows the register to be closed only one date following the record date.

Q: What is the purpose of the record date?

A: The record date allows listed companies to distribute the meeting notice much ahead of time. The shareholders, therefore, have more time to study the meeting documents before attending the meeting. Besides, extending the register closing gives the shareholders more time to register changes in share ownership.

Q: What is the procedure for holding the Annual General Shareholders' Meeting using the record date?

A: The pre-meeting steps are as follows:

In case of using the record date for determining the shareholders' rights such as the right to receive dividends, the SET recommends that listed companies set the record date at least five business days after the dissemination date of the shareholders' meeting resolutions.

Q: Is it permissible to set the record date one day after the board of directors meeting?

A: No. Pursuant to the SET regulation on information disclosure, listed companies must notify the SET of its record date 14 days before the record date.

Q: Is it acceptable to set the AGM date within the span of two months after the record date? Or must it be any date after the two-month span has passed?

A: The AGM date can be any day within the two-month span after the record date?

Q: Is the person who receives shares after the record date entitled to the voting right and any others on the AGM date?

A: Only the shareholders whose names appear in the register on record date have the right to attend the meeting; those who receive shares after the record date are not entitled to such right.

Q: If necessary, how could the record date be changed?

A: Pursuant to Section 89/26, the board of directors is not allowed to change the set record date unless a circumstance makes it impossible to hold the AGM on the set meeting date. In such case, the board may cancel the AGM, which in effect will also deem the existing record date cancelled. Under this circumstance, the company must reset the record date for the sake of holding the next AGM.

Q: Will the company be affected if a former shareholder who has transferred shares to another person after the record date attends the meeting and exercises the voting right instead of the new shareholder even though the former shareholder no longer has any stake in the company?

A: This is similar to the principle of register closing date whereby any shareholder who transfers off his shares after such date is still entitled to attend the shareholders' meeting. Pursuant to Section 89/26, the right of such person remains intact even though the information in the register as of the AGM date has changed.

Q: Since the record date rule is inconsistent with the Public Limited Companies Act, which is the primary governing law between the Public Limited Companies Act and the Securities and Exchange Act?

A: Any company under the Securities and Exchange Act must comply with the regulations specified by the Act, and since the record date requirement is in accordance with the Securities Law, such company is not required to close the register for suspension of share transfer as prescribed by the Public Limited Companies Act. The closing of the register on the next business day following the record date is meant to facilitate the making of a complete list of the shareholders whose names are in the register on the record date.

Q: Is the register closing for dividend payment based on the record date concept as well?

A: Under the Securities and Exchange Act, the record date only applies to the holding of the shareholders' meeting; however, the SET recommends that listed companies also apply the record date to other situations, e.g., dividend payment and right offering of capital shares.

Q: In case the meeting forms a quorum but must be postponed after continuing beyond expected without completing the consideration of every matter in the agenda, will the same shareholders' list apply or must it be updated upon another closing of the register before the meeting can be resumed?

A: The board may set a new meeting date and a new record date in accordance with Section However, the company may choose to resume the meeting without setting another record date, which is permissible under the Public Limited Companies Act as long as the company has duly complied with Section 89/26.