Corruption is a global phenomenon, particularly in developing economies where a large, various number of factors are causative to corruption. Such negative environment is a serious obstacle to social and economic growth and sustainable development in the long run.

Countries around the world have collaborated in the fight against corruption. One of the significant milestones is the establishment of Transparency International (TI) – an international non-profit, non-partisan agency supported by the World Bank, governments and multinational organizations. TI’s primary objectives are: (1) to put corruption issue on the global agenda, (2) to play a major role in the creation of anti-corruption conventions, and 3) to raise public sector standards in solving corruption issues. In 1995, TI introduced the Corruption Perceptions Index (CPI) as an indicator of the perceived levels of corruption in each country. The assessment has been conducted annually since then.

On legal framework initiative, the United Nations held a meeting at the headquarters of the United Nations Office on Drugs and Crime (UNODC) to discuss possibilities of using legal tools to tackle corruption. In 2003,the General Assembly adopted the United Nations Convention against Corruption (UNCAC) and appointed the UNODC as the UNCAC Secretary. In addition, December 9 was officially designated as the International Anti-Corruption Day to raise the global awareness of corruption and the roles of the UNCAC in combating and preventing it. The UNCAC requires that member countries promulgate laws for the prevention of corruption, including infliction and cooperation for international legal framework and law enforcement. The court’s cooperation for inspection of assets and information exchange is also requested to support effective combat against corruption.

In Thailand, many agencies have been established to prevent and combat against corruption, for example, the Office of the National Anti-Corruption Commission (ONAC), the Office of the Public Sector Anti-Corruption Commission (PACC), the Anti-Money Laundering Office (AMLO), and the Office of the Auditor General of Thailand. While relevant laws and regulations on punishment of corruption are enforced, cooperation among private sectors is also essential for solving the issue. The leading alliance is the Private Sector Collective Action Coalition Against Corruption (CAC), which is endorsed by the Government and the Office of the National Anti-Corruption Commission (ONAC), and operated by seven leading organizations – (1) the Thai Institute of Directors, (2) the Thai Chamber of Commerce, (3) the International Chamber of Commerce, (4) the Thai Listed Companies Association, (5) the Thai Bankers Association, (6) the Federation of Thai Capital Market Organization, and (7) the Federation of Thai Industries.

Capital market development and corruption issue

To combat the major national issue of corruption at all levels is not only the government’s job; it requires commitment and collaboration among private sectors. The SEC, therefore, encourages listed companies, securities companies, and asset management companies to join the Private Sector Collective Action Coalition Against Corruption (CAC) to enhance integrity and transparency in the Thai capital market, and be a role model for non-listed companies and other business organizations when it comes to building capital market confidence and promoting robust economic growth.

The SEC also encourages listed companies to establish and implement anti-corruption measures and requires them to disclose such policy and performance in the annual report, the One Report (Form 56-1), and the registration statement for offering of securities (Form 69-1). Such disclosed information not only benefits investors but also helps listed companies self-assess their own progress and make necessary improvement.

In addition, five major institutional investors – the Government Pension Fund, the Social Security Office,theAssociation of Investment Management Companies, the Thai Listed Companies Association, and the Thai LifeAssurance Association – have joined force to fight corruption and announced the declaration of intent to set up the Ethical Investment Framework on 11 March 2013. The framework contains operating and investment guidelines for institutional investors such as Proxy Voting Guidelines, to promote good corporategovernance,corporate social responsibility and anti-corruption practices of listed companies and the international recognition of the capital market.

The economic crisis in 1997 essentially marked the beginning of serious awareness of the importance of corporate governance. Since then it has become a primary tool for building public confidence in the capital market, for example, in the forms of policy and framework. The Thai Government designated 2002 as the “Year of Good Corporate Governance.” The National Corporate Governance Committee (NCGC) was appointed in the same year. Chaired by the Prime Minister, the NCGC aims to promote the principles of good corporate governance and ensure delivery of concrete outcomes.

What is CG?

Corporate Governance refers to the system, practices, and process by which the company is directed and controlled to balance the interest of stakeholders, and to enhance efficiency, transparency and accountability of the company.

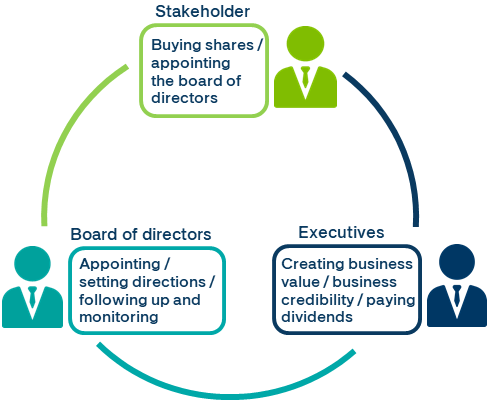

Corporate governance plays a significant role in a publicly listed company. Since not all shareholders can take part in the company’s operation, they have to appoint trusted persons to serve in the board of directors to monitor and supervise the company’s management on their behalf. To establish a circle of trust between the shareholders and the company, a corporate governance policy must be implemented and demonstrated. In essence, the board of directors has the duty to protect the interest of both the company and the shareholders, not take an unfair advantage by abusing their positions, and oversee the executives’ and the management’s performance to optimize corporate efficiency and investors’ returns. Meanwhile, the shareholders have the right to be well-informed, make decisions in material issues and review the performance of directors and executives.

Importance of corporate governance

Practicing good corporate governance offers benefits to the company and the capital market as follows:

Benefit to the company: (1) competitiveness and performance with long-term perspective (2) ethical and responsible business (3) good corporate citizenship and (4) corporate resilience.

Benefits to the capital market: Market confidence and liquidity, higher purchasing demands and product prices, and thus more attractive channels for corporate finance.

Corporate Governance International Standards

The

OECD Principles of Corporate Governance is an international standard adopted by many countries and were latest revised in 2023. The ASEAN Capital Market Forum (ACMF) applied the Principles to further revised the criteria of ASEAN Corporate Governance Scorecard which comprise four categories as follows:

A: Rights and Equitable Treatment of Shareholders

Principle: Protect and facilitate the exercise of shareholders’ rights and ensure the equitable treatment of all shareholders, including minority and foreign shareholders. All shareholders should have the opportunity to obtain effective redress for violation of their rights at a reasonable cost and without excessive delay.

B: Sustainability and Resilience

Principle: Provide incentives for companies and their investors to make decisions and manage their risks, in a way that contributes to the sustainability and resilience of the corporation.

C: Disclosure and Transparency

Principle: Ensure that timely and accurate disclosure is made on all material matters regarding the corporation, including the financial situation, performance, sustainability, ownership, and governance of the company.

D: Responsibilities of the Board

Principle: Ensure the strategic guidance of the company, the effective monitoring of management by the board, and the board’s accountability to the company and the shareholders.

International Corporate Governance Assessment

The Thai capital market has participated in several internationally recognized assessment programs, including CG ROSC (Report on the Observance of Standards and Codes-Corporate Governance Country Assessment) by the World Bank and CG Watch by the Asian Corporate Governance Association in collaboration with CLSA Asia-Pacific Markets. The overall results have shown that the Thai capital market has made significant progress in corporate governance oversight of listed companies and has earned its leading position in the region thanks to the improvement of CG standards through revision of laws, regulations and guidelines in consistent with international benchmarks.

A continuing focus is also given to local assessment programs on corporate governance practices of individual listed companies in line with international standards, for example, the Corporate Governance Report of Thai Listed Companies by the Thai Institute of Directors and the AGM (Annual General Shareholders’ Meeting) Assessment by the Thai Investors Association.

Upon establishment of the ASEAN Economic Community (AEC) to create collaboration among ASEAN countries in many key areas including capital market, the ASEAN Capital Market Forum (ACMF) developed an implementation plan to connect ASEAN capital markets and create mutual recognition of regulations and standards among its members. The collaboration has also included raising quality of corporate governance practices of ASEAN companies to be on par with international standards. One of the useful tools initiated by the ACMF is the ASEAN CG Scorecard, which gauges the corporate governance practices of ASEAN companies and discloses the assessment results for the benefit of investors’ decision making.

Corporate Governance Code for Listed Companies 2017

Thailand’s capital market has been using the SET’s Principles of Good Corporate Governance as its main mechanism for creating corporate governance for listed companies, and with satisfying results. In the beginning, the SET issued 15 corporate governance principles, which then further developed into the Principles of Good Corporate Governance 2012, divided into five topics in accordance with the OECD Principles at that time. To motivate listed companies to comply with these CG principles, the SEC requires listed companies to disclose their information in Form 56-1 in accordance with such CG principles, based on ‘comply or explain’. The Thai Institute of Directors Association evaluated the results from complying with the corporate governance principles, based on publicly disclosed information, in the Corporate Governance Report (CGR), which gives ratings of one to five stars and discloses the name of companies that receives three stars and above. This evaluation has encouraged listed companies to focus on developing their corporate governance to achieve higher results, together with the supporting measures, training activities, and rewards from various organizations including the SEC, SET, IOD, the Thai Listed Company Association (Thai LCA), the Thai Investor Association, and other related organizations. As a result, the overall corporate governance of listed companies in Thailand has emerged as a leader in this region. Although the development of corporate governance has been successful so far, further improvements will mean overcoming changes in social structure and global environment deterioration, which is partly caused by industrial development, capitalism, and business expansion, has made many national and international organizations and investors demand more social and environmental responsibilities, in addition to good corporate governance.

Therefore, the SEC realized the need to issue a new CG Code as guidelines for a board, who is the leader accountable for corporate governance mechanisms. The CG Code would integrate social and environmental issues into the business process to set the company’s direction, strategy, operating process, monitoring, and reporting, providing a framework for the board to govern listed companies to operate responsibly for the environment and society and to create sustainable value.

Task Force for Sustainability in Listed Companies