Concept

1. Objective of the Corporate Governance Code

Over the past years, “corporate governance” has referred to a relationship structure and practice to foster transparency and accountability of the board of directors to build investor confidence. Such confidence is essential to raising capital and being a public listed company.

Confidence is indeed important; it is however by itself not sufficient to make a company thrive for its shareholders. Shareholders and the business sector alike expect a company to have good performance and returns, a balanced relationship with stakeholders, and business agility and resilience in facing new challenges so that the company can compete and achieve long-term sustainability.

This Corporate Governance Code (the “CG Code”) is therefore developed as practice principles for the board of directors, as the leader and governing body of a listed company, to fulfil all of those expectations. The Principles of this CG Code integrate the essence of principles and best practices of the G20/OECD Principles of Corporate Governance, the Stock Exchange of Thailand Principles of Good Corporate Governance, principles of social and environment responsibilities for business, as well as the business leadership concept, and delineated as the board’s roles and responsibilities for the company’s long-term sustainable value creation. In this regard, the value created should not only be good for the company but also for its shareholders, stakeholders, the capital market and the society at large. If practiced in substance, the objective of long-term sustainable value creation should be reflected in the company’s business model, and ingrained in its corporate culture to ensure company-wide practices.

2. Corporate Governance

In the CG Code, “corporate governance” involves relationship and other arrangements to ensure that intended outcomes of the company are defined and achieved. For corporate governance purposes, the board’s roles and responsibilities include (1) defining objectives*, (2) determining means to attain the objectives, and (3) monitoring, evaluating, and reporting on performance.**

“Good corporate governance” involves not only building investor confidence and trust but also ensuring business integrity and creating long-term business value. In conducting its leadership roles and responsiblilities, the board should strive for the following governance outcomes:

1. competitiveness and performance with long-term perspective;

2. ethical and responsible business;

3. good corporate citizenship; and

4. corporate resilience.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

* The term ‘objectives’ includes long-term central ideas of the company as well as shorter term business objectives. The central ideas refer to the fundamental purpose, principles, vision, values and business model of the company.

** This definition is in line with the G20/OECD’s definition of “Corporate Governance”: “corporate governance involves a set of relationships between a company's management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined”. (G20/OECD Principles of Corporate Governance, 2015, p.9)

3. The Corporate Governance Code

The CG Code has two main parts:

Part 1: Principles and Sub-Principles

Part 2: Guidelines and Explanations

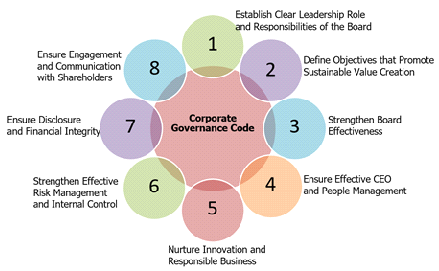

3.1 The CG Code Principles

Principle 1: Establish clear leadership role and responsibilities of the board

Principle 2: Define objectives that promote sustainable value creation

Principle 3: Strengthen board effectiveness

Principle 4: Ensure effective CEO and people management

Principle 5: Nurture innovation and responsible business

Principle 6: Strengthen effective risk management and internal control

Principle 7: Ensure disclosure and financial integrity

Principle 8: Ensure engagement and communication with shareholders

3.2 Implementation of the Corporate Governance Code Implementation of the CG Code is on an ‘apply or explain’ basis; the board is encouraged to apply each Principle and Sub-Principle by means that are suitable for the company’s business. If any of the Principles or Sub-Principles cannot be applied or are not applicable, the board shall provide an explanation as appropriate. The Guidelines and Explanations in part 2 are for further clarification and contain recommended practices in relation to each Principle and Sub-Principle. In contrast to a ‘comply or explain’ requirement, the ‘apply or explain’ basis intends to encourage the board to comprehensively apply the CG Code to the company’s business in the interest of long-term sustainable value creation. A company’s board should conduct and record an annual internal review of the implementation of the CG Code. Effective from 2018, the company is required to disclose in the annual report and Form 56-1 an acknowledgement of the board that it has considered and reviewed the CG Code by means that are suitable to the company’s business. CG Code implementation could be an indicator of proper performance of board duties and responsibilities. 3.3 Explaining the Unapplied Principles and Sub-Principles In order to apply the CG Code’s Principles and Sub-Principles, the board should consider their suitability to the company’s business, resulting in the board’s ‘conscientious’ decision about their application. This should be:1. recorded as a board resolution, reflecting that the board has, on an informed basis, annually reviewed the application of of the CG Code’s Principles and Sub-Principles, including reasons for not following any particular Principle or Sub-Principle, and alternative practices (if any) that can fulfil the intended outcomes of the Principles and Sub-Principles.

2. disclosed in the company’s annual report and the SEC Form 56-1.

- The SEC Form 56-1 disclosure remains unchanged. To the extent that disclosure is required pursuant to SEC Form 56-1, a company is expected to succinctly explain the reasons for not following a particular CG Code Principle or Sub-Principle. Matters that must be disclosed relating to the CG Code include corporate governance policy, board committees, nomination and appointment of directors and key executives, governance of subsidiaries and associated companies, control over use of insider information, auditor’s fees, and compliance with CG and Corporate Social Responsibility standards.

- The disclosure must include an acknowledgement of the board that it has properly considered and reviewed the application of the CG Code Principles and Sub-Principles. The company is not obliged to disclose the full content of the board resolution

4. The Corporate Governance Code Compared to the Stock Exchange of Thailand Principles of Good Corporate Governance for Listed Companies 2012

This CG Code is based on the Stock Exchange of Thailand Principles of Good Corporate Governance for Listed Companies 2012 but reflects current international standards and trends by focusing on the roles and responsibilities of the board for each aspect of governance, as follows:

1. The board’s leadership role is highlighted, and the roles and responsibilities of the board and management are clearly defined.

2. The board is responsible for defining objectives, while taking into account the company’s ecosystem, stakeholder engagement, and environmental and social responsibilities.

3. The board is responsible for oversight of the company’s strategies, policies, business plans and budgets, including IT governance and encouraging innovation and use of technology to support sustainable value creation.

4. The board is responsible for oversight of the company’s communication and disclosure policy to protect the company’s sensitive and confidential information.

5. The board is responsible for monitoring financial liquidity and debt servicing ability, establishing a mechanism to support operations under tight financial constraints, and ensuring financial literary education for employees, and establishing provident funds.

6. The board should demonstrate a thorough understanding of the company’s shareholder structure and its impact on the control and management of the company.

7. The role of the chairman of the board should be clearly defined. If the persons acting as the chairman and the chief executive officer are the same or connected, the board may appoint a designated independent director to participate in setting the agenda of board meetings.

5. Moving Forward

1. The board should demonstrate a thorough understanding of its responsibilities and leadership role in driving good corporate governance. This includes providing effective oversight of the business, stakeholder engagement, and the company’s opportunities and risks.

2. The board should nurture a constructive relationship with management to enable collaborative leadership.

3. The board should ensure that any person involved in supporting board performance (including chief financial officer, company secretary, and internal auditor) has relevant knowledge, experience, and skills.

Moreover, the board should promote continuous education and development of directors through training and performance evaluation, to ensure that the directors have sufficient and suitable knowledge and understanding of all information relevant to their responsibilities and oversight duties.

6. Acknowledgement

The Securities and Exchange Commission would like to express sincere appreciation to the Task Force for Sustainability in Listed Companies, the Corporate Governance experts of the Stock Exchange of Thailand, and representatives from listed companies, for their valuable contributions to the practical relevance of this CG Code.

The Securities and Exchange Commission would also like to thank PricewaterhouseCoopers ABAS Ltd. and Ms. Karin Zia-Zarifi, Consultant of the Securities and Exchange Commission for their assistance with the translation.